Federal Resource Allocation Efficiency Audit

A Systems Analysis of Recoverable Misallocation in U.S. Federal Spending

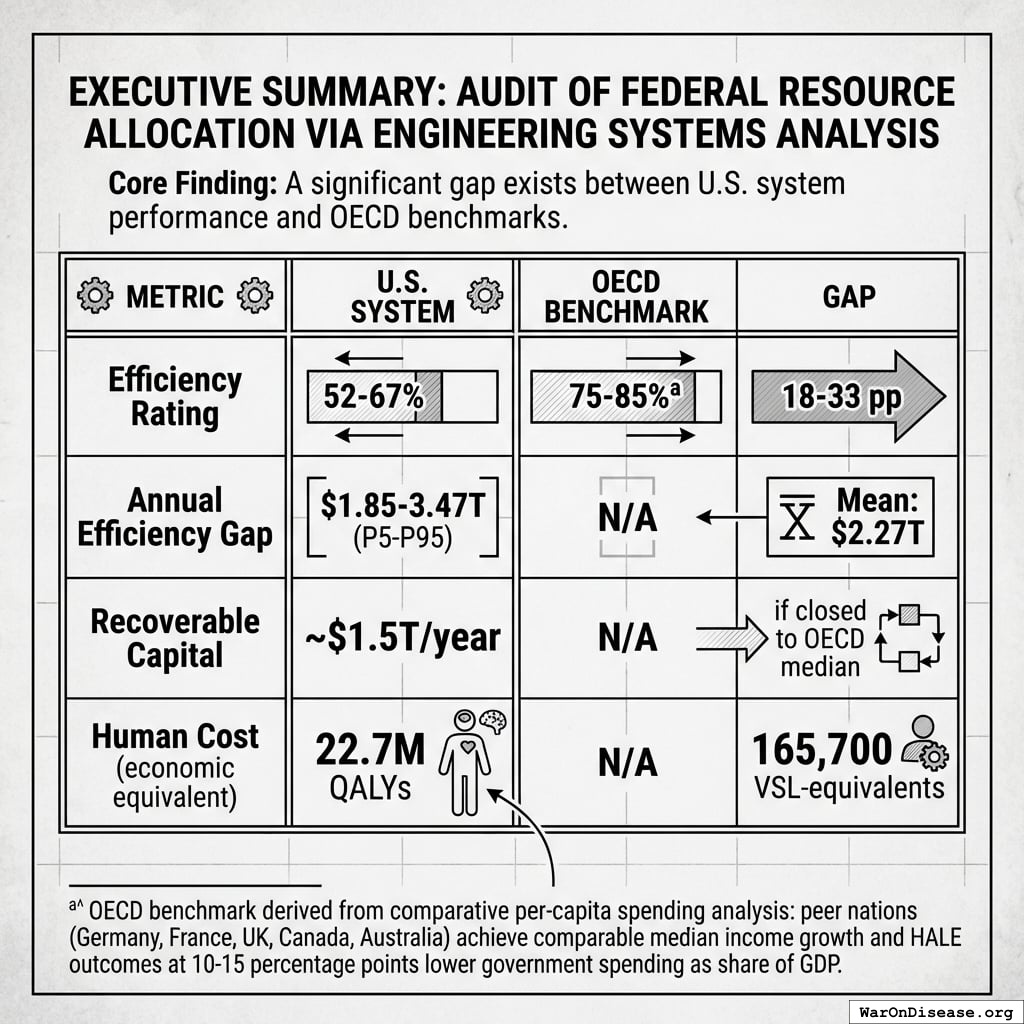

This report applies systems engineering methodology to quantify allocative inefficiency in U.S. federal spending. We define government efficiency as the rate of converting fiscal inputs into two terminal outcomes: after-tax real median income growth and median healthy life years. Analysis reveals the U.S. system operates at 52-67% efficiency versus 75-85% for OECD benchmark nations. Using Monte Carlo simulation across five subsystems (defense, healthcare, justice, regulatory/tax, and subsidies), we estimate an Aggregate Efficiency Gap of $1.85-3.47 trillion annually (P5-P95 range, mean $2.27T). Closing this gap to OECD median levels would recover approximately $1.5 trillion per year. The economic equivalent of current inefficiency equals 22.7 million QALYs or 165,700 VSL-equivalents annually.

allocative efficiency, systems analysis, federal spending, defense spending, healthcare administration, regulatory burden, OECD benchmarking, Monte Carlo simulation

Executive Summary

This audit applies engineering systems analysis to federal resource allocation. The core finding:

| Metric | U.S. System | OECD Benchmark | Gap |

|---|---|---|---|

| Efficiency Rating | 52-67% | 75-85%a | 18-33 pp |

| Annual Efficiency Gap | $1.85-3.47T (P5-P95) | N/A | Mean: $2.27T |

| Recoverable Capital | ~$1.5T/year | N/A | if closed to OECD median |

| Human Cost (economic equivalent) | 22.7M QALYs | N/A | 165,700 VSL-equivalents |

a OECD benchmark derived from comparative per-capita spending analysis: peer nations (Germany, France, UK, Canada, Australia) achieve comparable median income growth and HALE outcomes at 10-15 percentage points lower government spending as share of GDP.

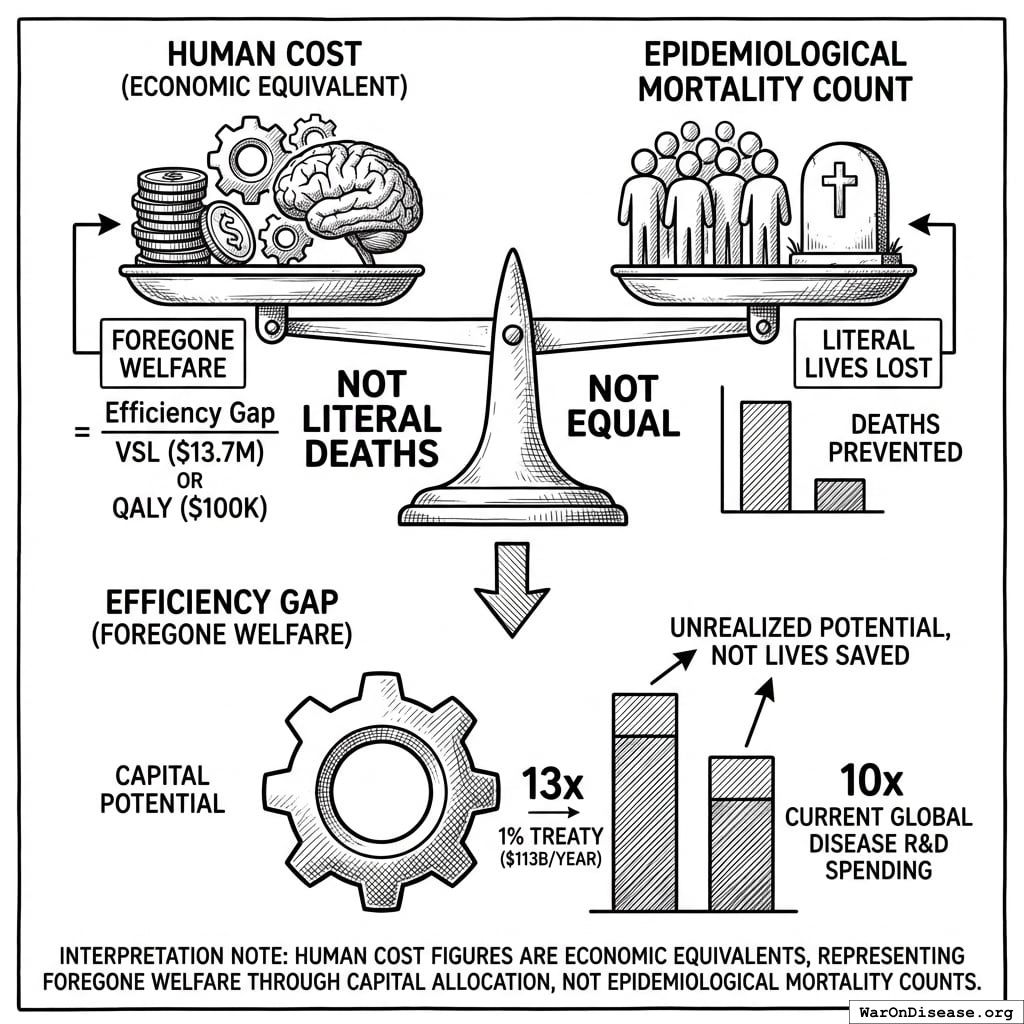

The “human cost” figures are economic equivalents, not epidemiological mortality counts. Dividing the efficiency gap by VSL ($13.7M) or QALY threshold ($100K) yields a measure of foregone welfare, not literal deaths prevented.

The efficiency gap represents capital that could fund the 1% Treaty ($27.2B/year) 55 times over, or 10x current global disease R&D spending.

System Specifications

Designed Function

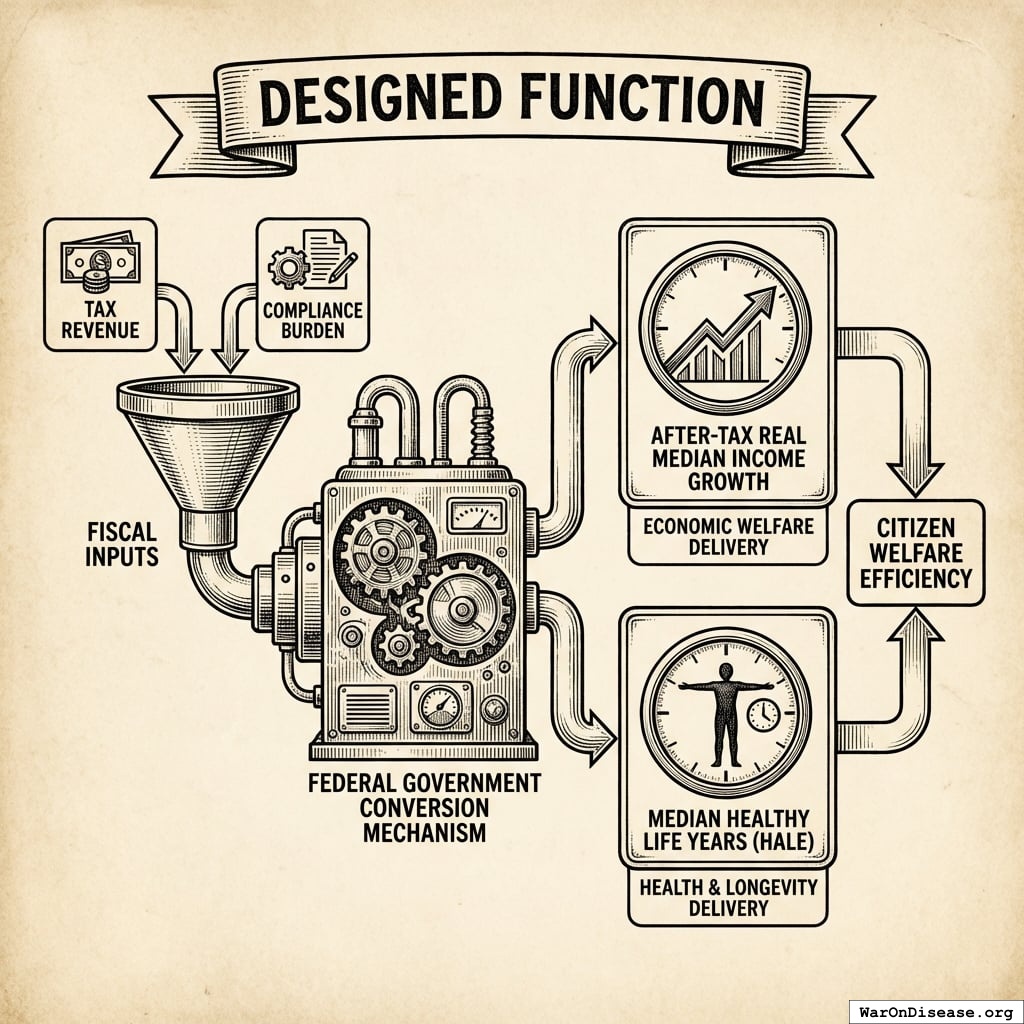

The federal government’s designed function is to convert fiscal inputs (tax revenue + compliance burden) into citizen welfare. We measure this conversion efficiency using two terminal outcomes:

- After-tax real median income growth: measures economic welfare delivery

- Median healthy life years (HALE): measures health and longevity delivery

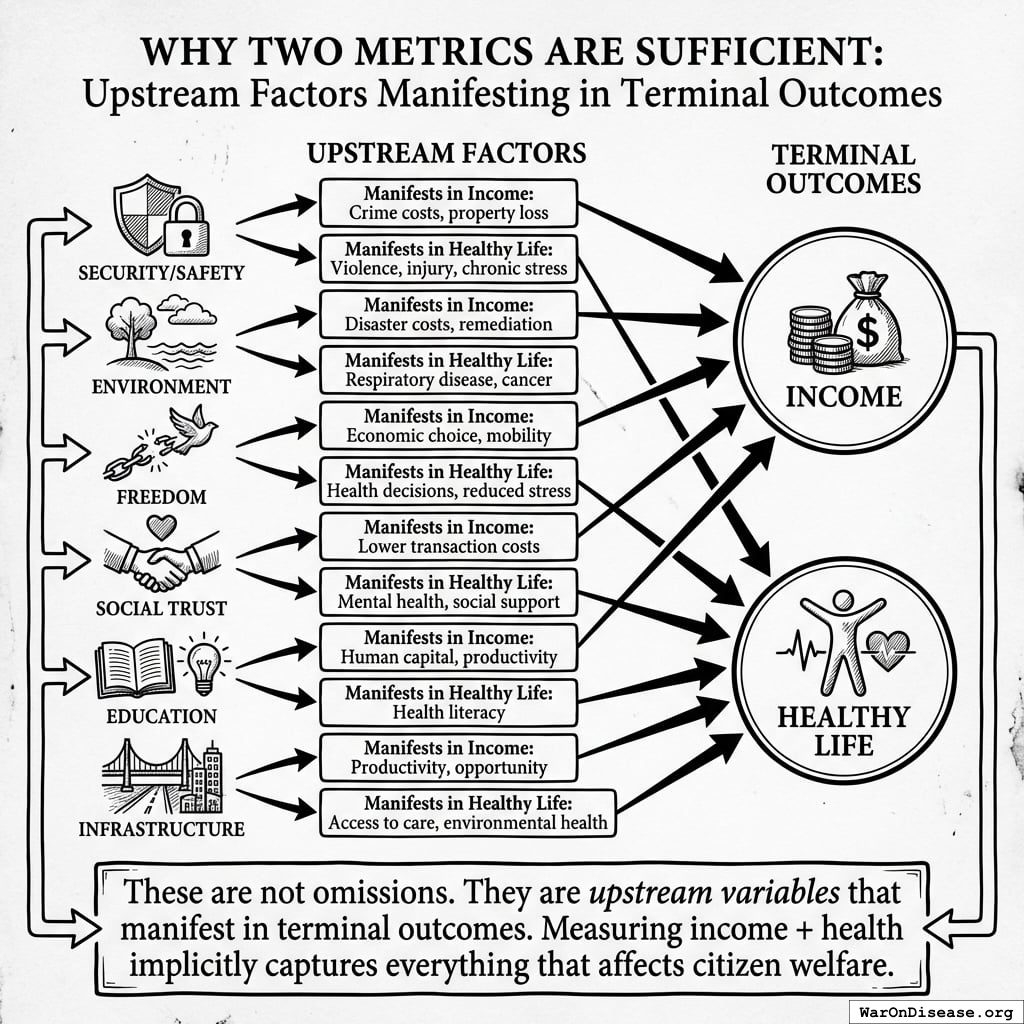

Why Two Metrics Are Sufficient

These two outputs capture all upstream factors that matter:

| Upstream Factor | Manifests in Income | Manifests in Healthy Life |

|---|---|---|

| Security/Safety | Crime costs, property loss | Violence, injury, chronic stress |

| Environment | Disaster costs, remediation | Respiratory disease, cancer |

| Freedom | Economic choice, mobility | Health decisions, reduced stress |

| Social Trust | Lower transaction costs | Mental health, social support |

| Education | Human capital, productivity | Health literacy |

| Infrastructure | Productivity, opportunity | Access to care, environmental health |

These are not omissions. They are upstream variables that manifest in terminal outcomes. Measuring income + health implicitly captures everything that affects citizen welfare.

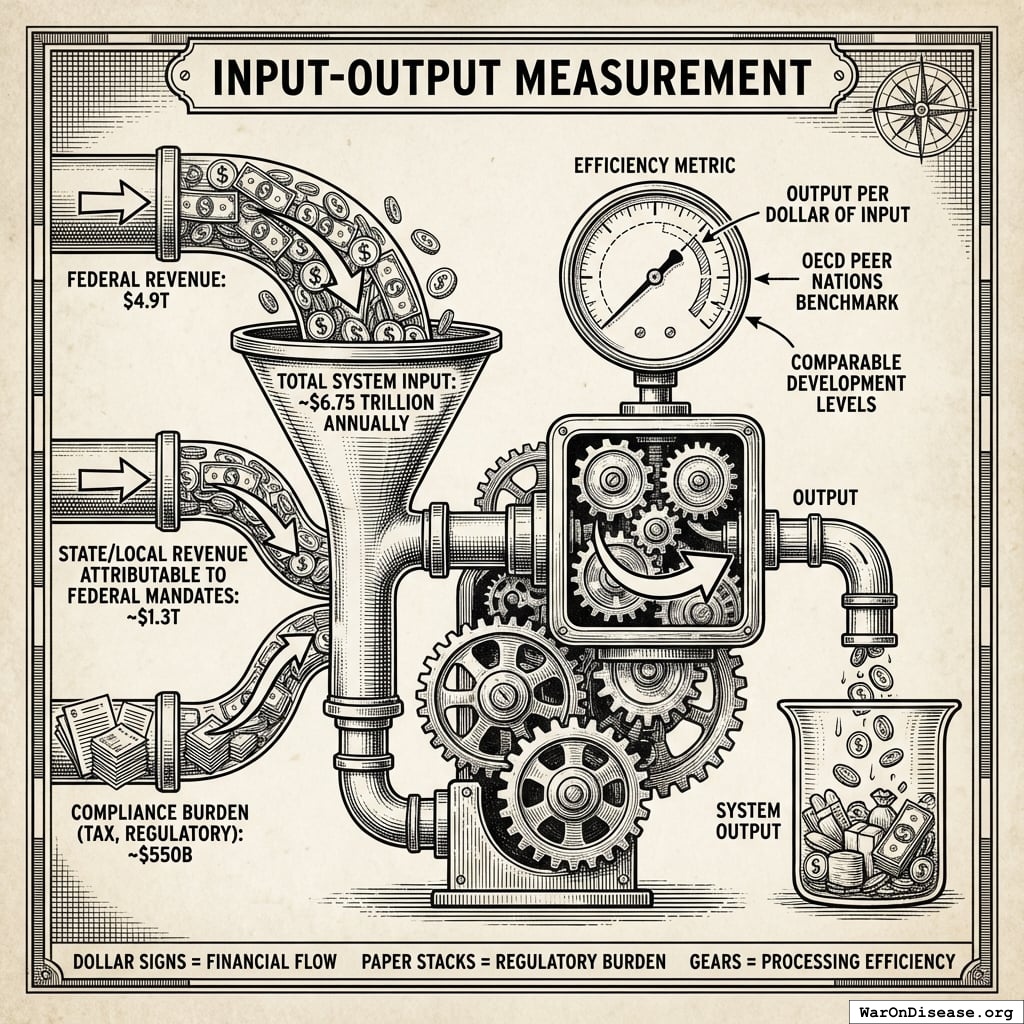

Input-Output Measurement

Total System Input: ~$6.75 trillion annually

- Federal revenue: $4.9T142

- State/local revenue attributable to federal mandates: ~$1.3T143

- Compliance burden (tax, regulatory): ~$550B17,144

Efficiency Metric: Output per dollar of input, benchmarked against OECD peer nations with comparable development levels.

Methodology

Engineering Loss Categories

We categorize resource losses using engineering terminology rather than political language:

| Loss Category | Definition | Examples |

|---|---|---|

| Friction Losses | Administrative overhead exceeding minimum necessary | Healthcare billing complexity, tax compliance burden |

| Leakage | Fraud, improper payments, unverified expenditure | Medicare improper payments, unaudited DoD assets |

| Parasitic Load | Bureaucracy maintaining itself rather than serving function | Redundant agencies, regulatory capture |

| Transmission Loss | Efficiency loss in federal → state → local → citizen transfer | Grant administration overhead, unfunded mandates |

| Idle/Standby Loss | Capacity maintained but unused | Excess military bases, redundant weapons systems |

| Conversion Inefficiency | Policy intent failing to achieve stated outcome | Drug interdiction not reducing use |

| Negative Work | Policies producing net harm rather than benefit | Incarceration increasing recidivism |

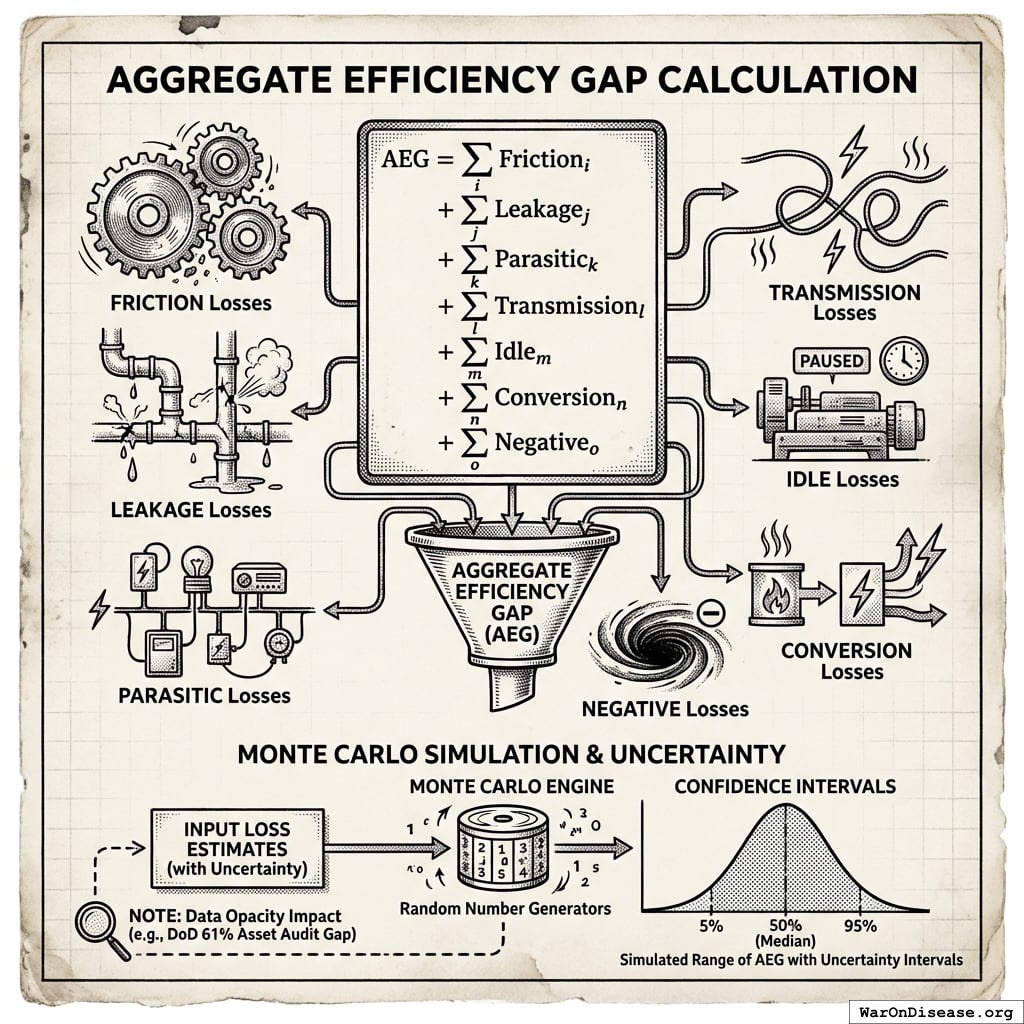

Aggregate Efficiency Gap Calculation

The Aggregate Efficiency Gap (AEG) sums losses across all categories:

\[\text{AEG} = \sum_{i} \text{Friction}_i + \sum_{j} \text{Leakage}_j + \sum_{k} \text{Parasitic}_k + \sum_{l} \text{Transmission}_l + \sum_{m} \text{Idle}_m + \sum_{n} \text{Conversion}_n + \sum_{o} \text{Negative}_o\]

We employ Monte Carlo simulation to generate confidence intervals, recognizing uncertainty in loss estimates (particularly where data opacity exists, such as the DoD’s inability to audit 61% of assets).

While subsystem losses are estimated independently, some interdependence exists. For example, housing cost burdens affect health outcomes via stress; incarceration costs overlap with drug enforcement spending. This analysis treats categories as largely additive, which may modestly overstate total losses. However, excluded categories (state/local inefficiency, implicit subsidies, behavioral effects) likely offset this bias.

Valuation Standards

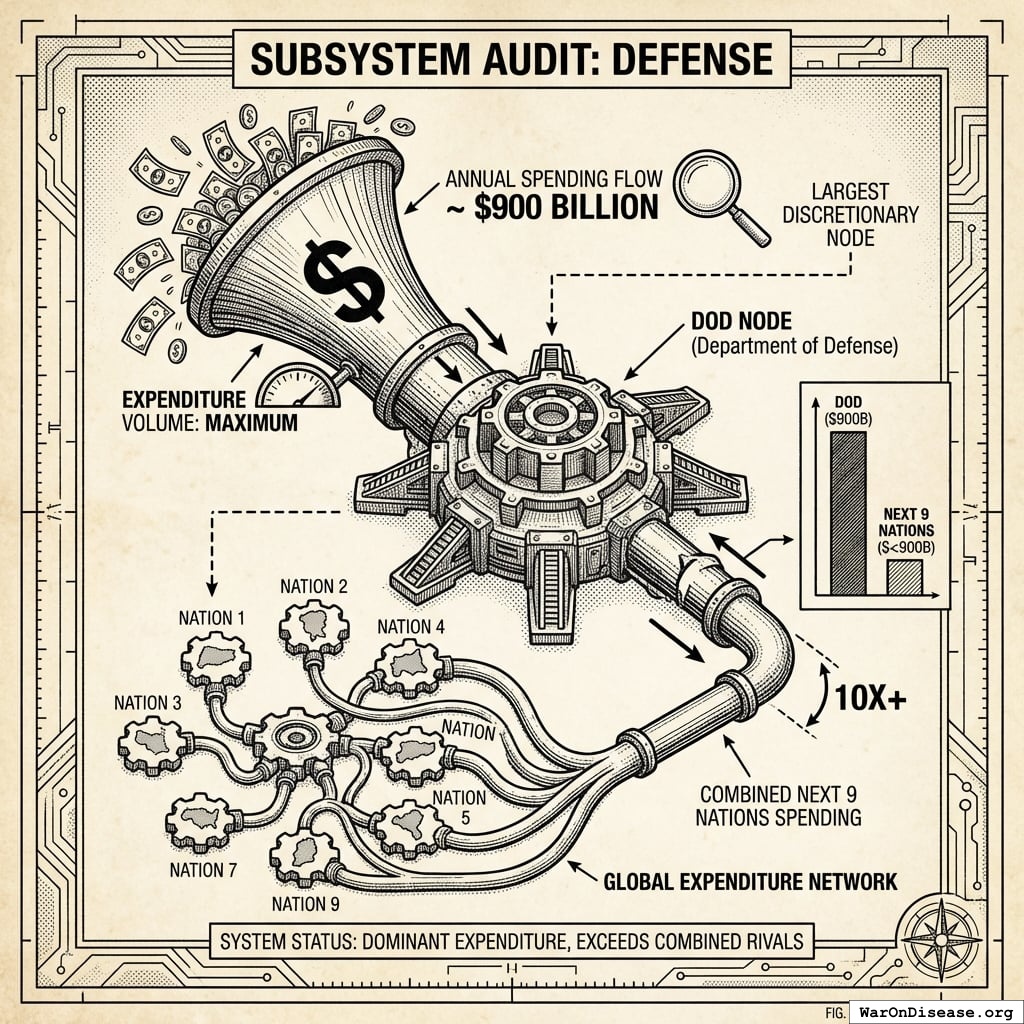

Subsystem Audit: Defense

The Department of Defense operates as the largest discretionary expenditure node, with annual spending of approximately $900 billion147. Current spending exceeds the next nine nations combined148.

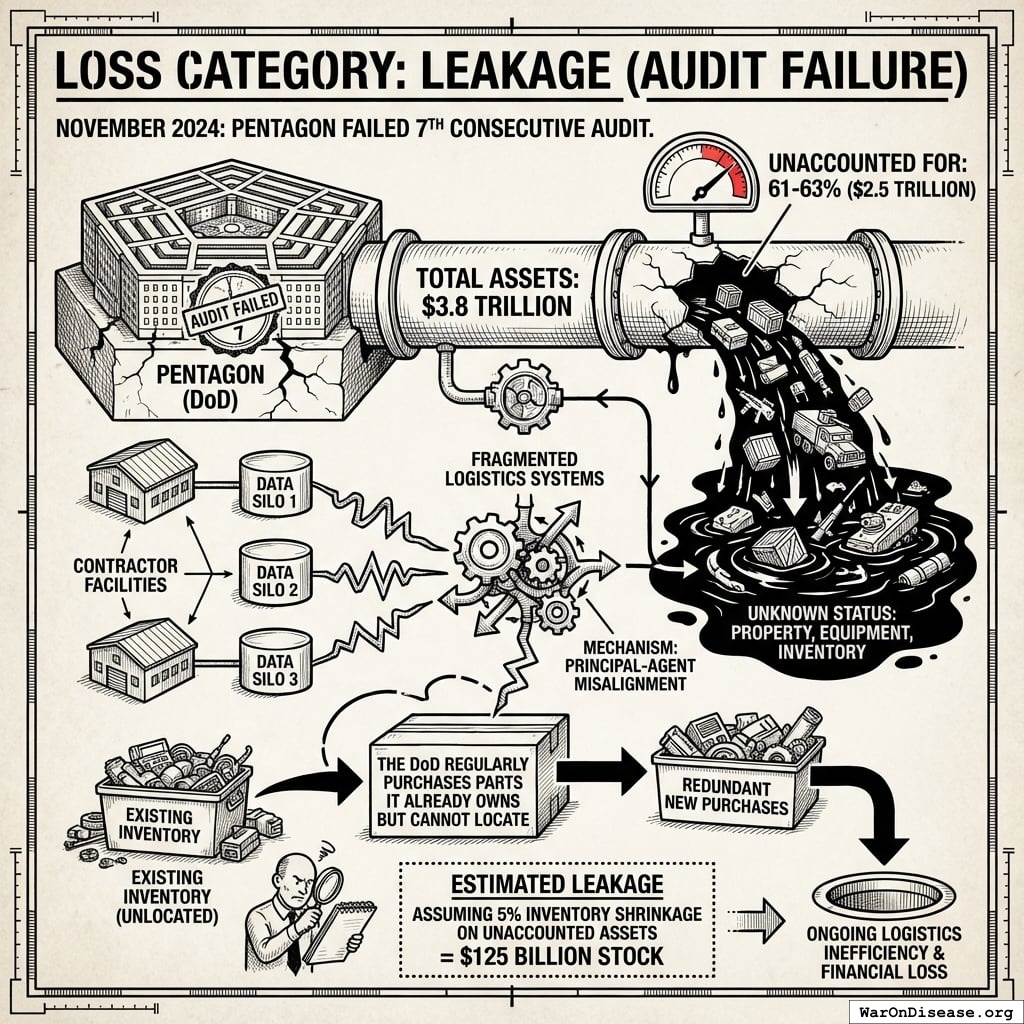

Loss Category: Leakage (Audit Failure)

In November 2024, the Pentagon failed its seventh consecutive audit149. The DoD was unable to account for 61-63% of its $3.8 trillion in assets150, approximately $2.5 trillion in property, equipment, and inventory with unknown status.

The mechanism: fragmented logistics systems where contractors record inventory data, creating principal-agent misalignment151. Without verified asset ledgers, the DoD regularly purchases parts it already owns but cannot locate.

Estimated leakage: Assuming 5% inventory shrinkage on unaccounted assets = $125 billion stock, plus ongoing logistics inefficiency.

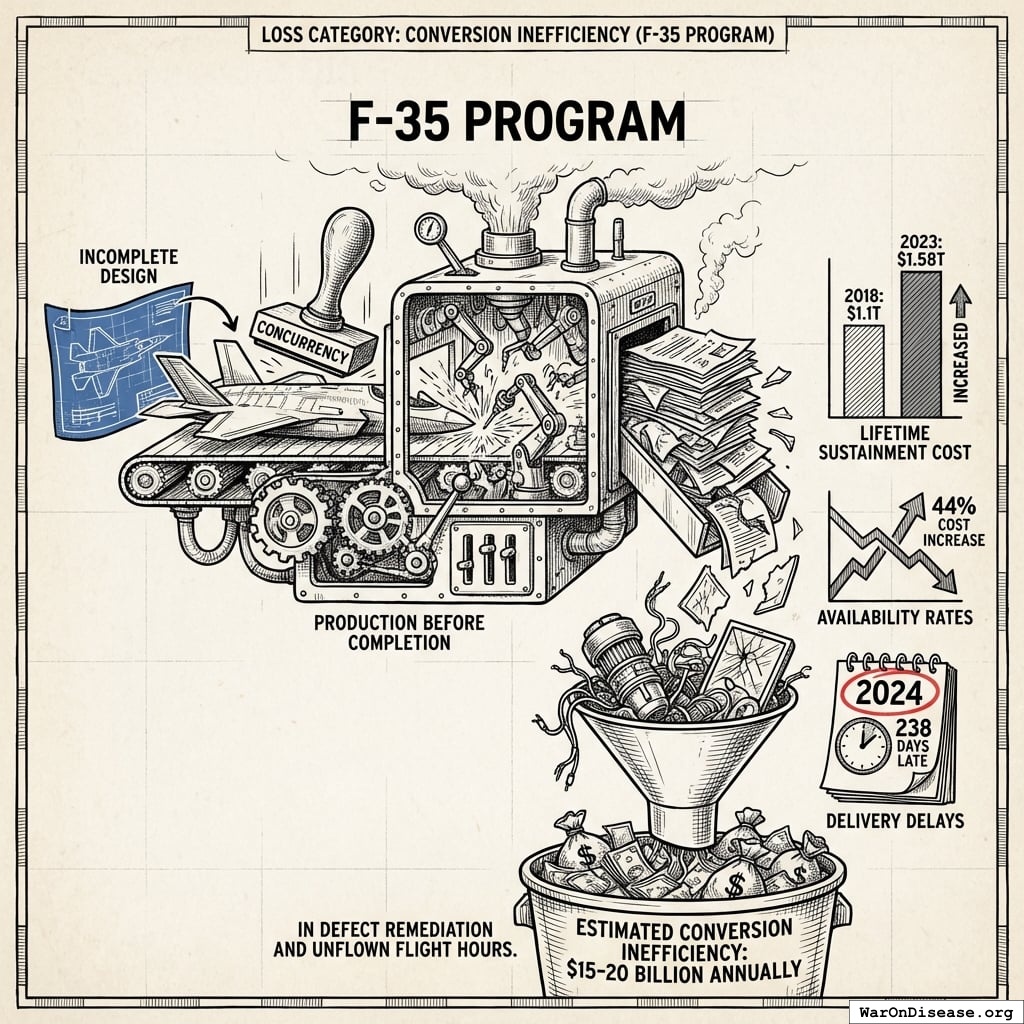

Loss Category: Conversion Inefficiency (F-35 Program)

The F-35 program exemplifies “concurrency”: producing aircraft before design completion. Results:

- Lifetime sustainment cost: increased from $1.1T (2018) to $1.58T (2023)152

- Availability rates: declining despite 44% cost increase152

- 2024 delivery delays: average 238 days late153

Estimated conversion inefficiency: $15-20 billion annually in defect remediation and unflown flight hours.

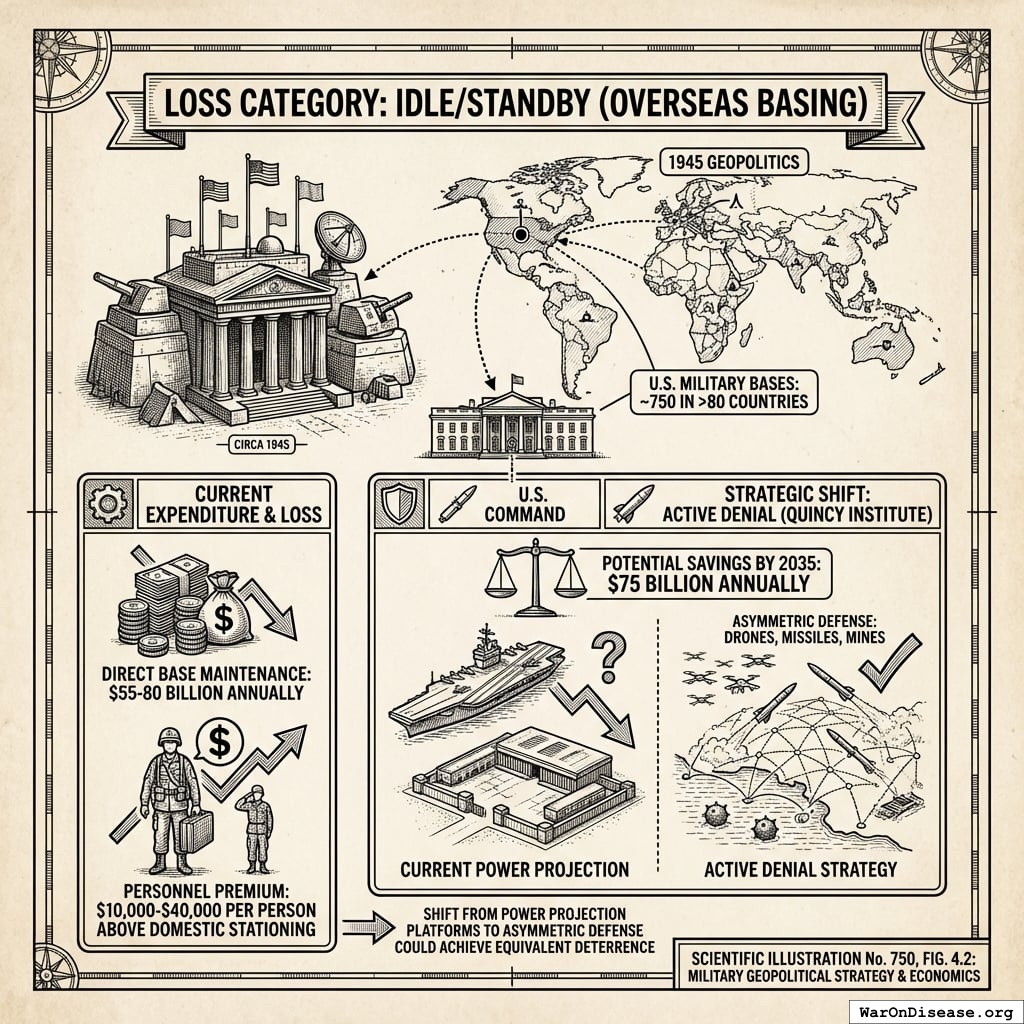

Loss Category: Idle/Standby (Overseas Basing)

The U.S. maintains approximately 750 military bases in over 80 countries154, architecture designed for 1945 geopolitics.

- Direct base maintenance: $55-80 billion annually154

- Personnel premium: $10,000-$40,000 per person above domestic stationing155

The Quincy Institute estimates that shifting to “Active Denial” strategy (asymmetric defense via drones, missiles, mines rather than power projection platforms) could achieve equivalent deterrence at $75 billion annual savings by 2035156.

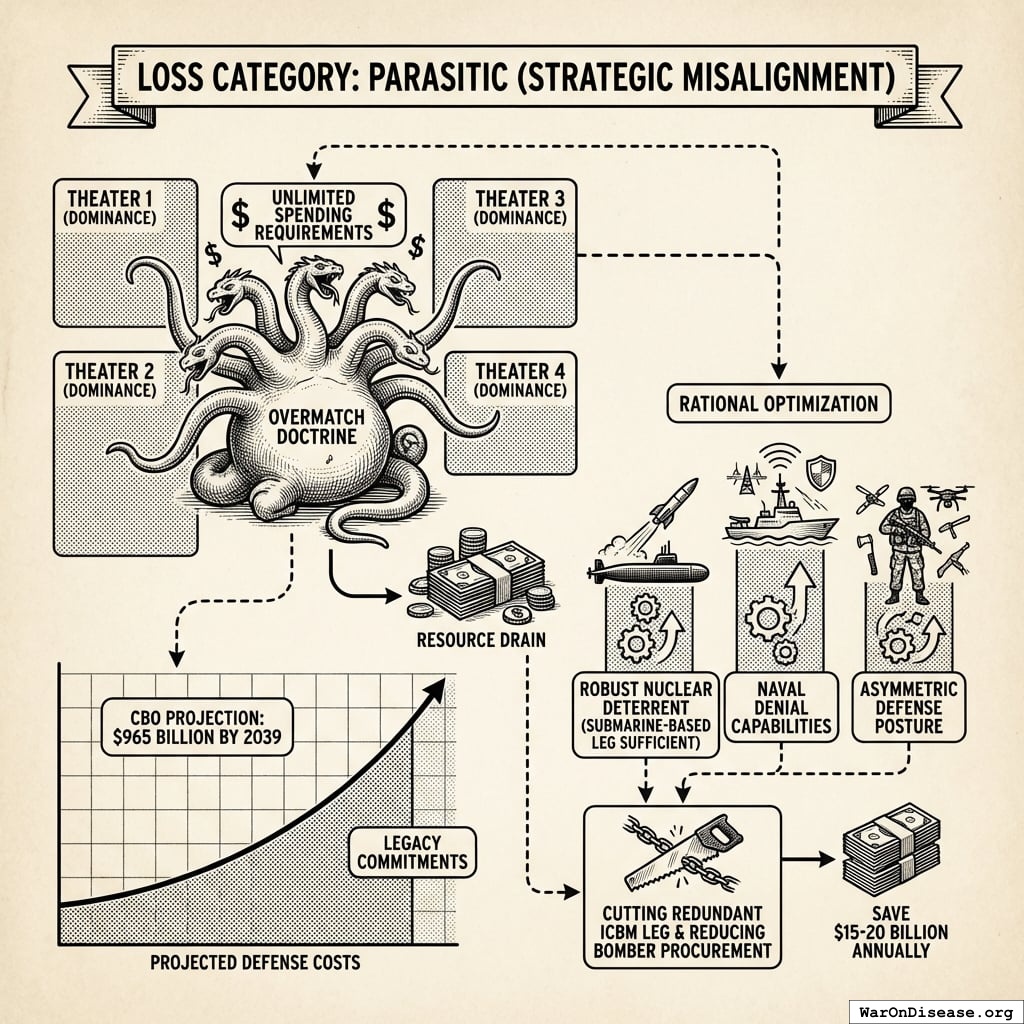

Loss Category: Parasitic (Strategic Misalignment)

The “Overmatch” doctrine requires dominance in every theater simultaneously, creating unlimited spending requirements. The Congressional Budget Office projects defense costs will rise to $965 billion by 2039157, driven by this refusal to rationalize legacy commitments. A rational optimization would focus on:

- Robust nuclear deterrent (submarine-based leg sufficient)

- Naval denial capabilities

- Asymmetric defense posture

Cutting the redundant ICBM leg and reducing bomber procurement would save $15-20 billion annually158.

Defense Subsystem Summary

| Loss Category | Low Estimate | Mean | High Estimate |

|---|---|---|---|

| Leakage (audit) | $50B | $75B | $100B |

| Conversion (F-35) | $15B | $17B | $20B |

| Idle (bases) | $40B | $55B | $75B |

| Parasitic (strategy) | $50B | $63B | $105B |

| Total | $100B | $210B | $300B |

Subsystem Audit: Healthcare Administration

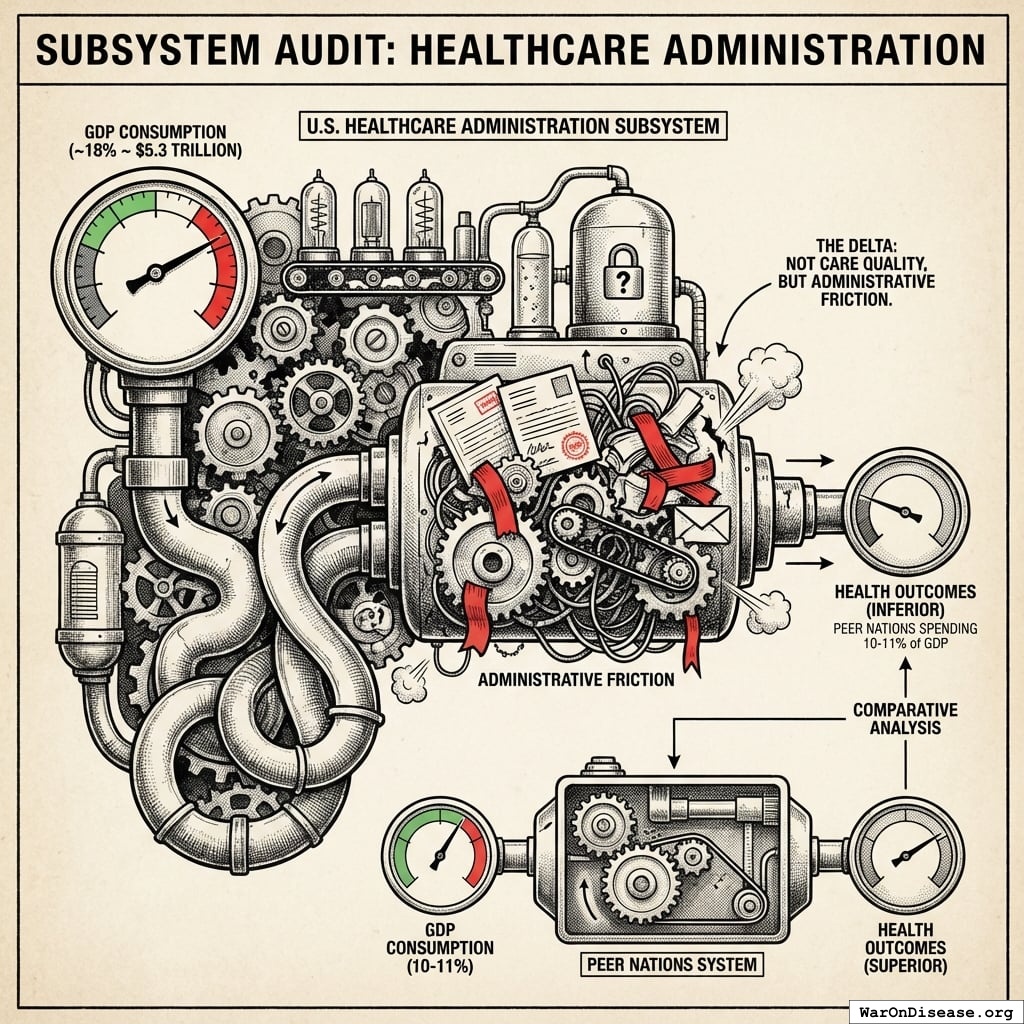

U.S. healthcare consumes ~18% of GDP ($5.3 trillion)159 yet delivers health outcomes inferior to peer nations spending 10-11% of GDP160. The delta is not care quality. It is administrative friction.

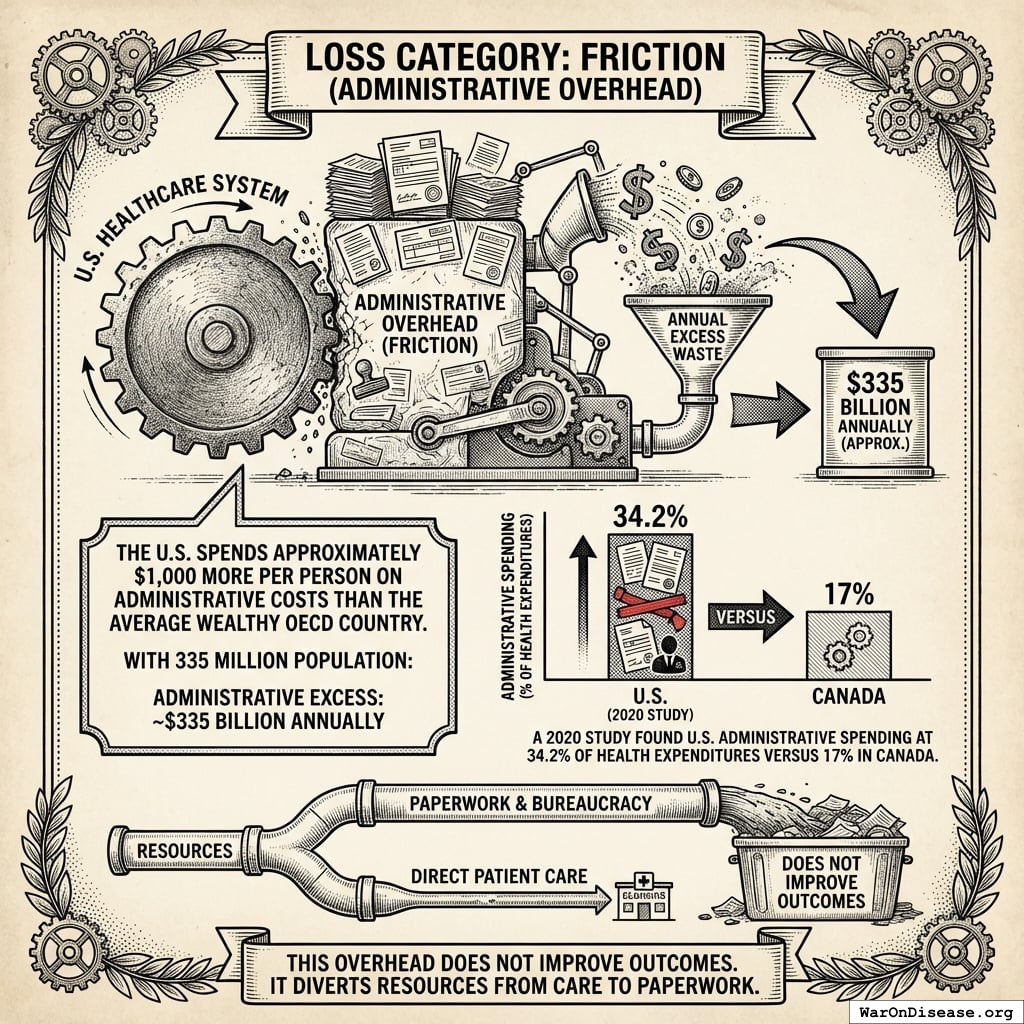

Loss Category: Friction (Administrative Overhead)

The U.S. spends approximately $1,000 more per person on administrative costs than the average wealthy OECD country160. With 335 million population:

Administrative excess: ~$335 billion annually

A 2020 study found U.S. administrative spending at 34.2% of health expenditures versus 17% in Canada161. This overhead does not improve outcomes. It diverts resources from care to paperwork.

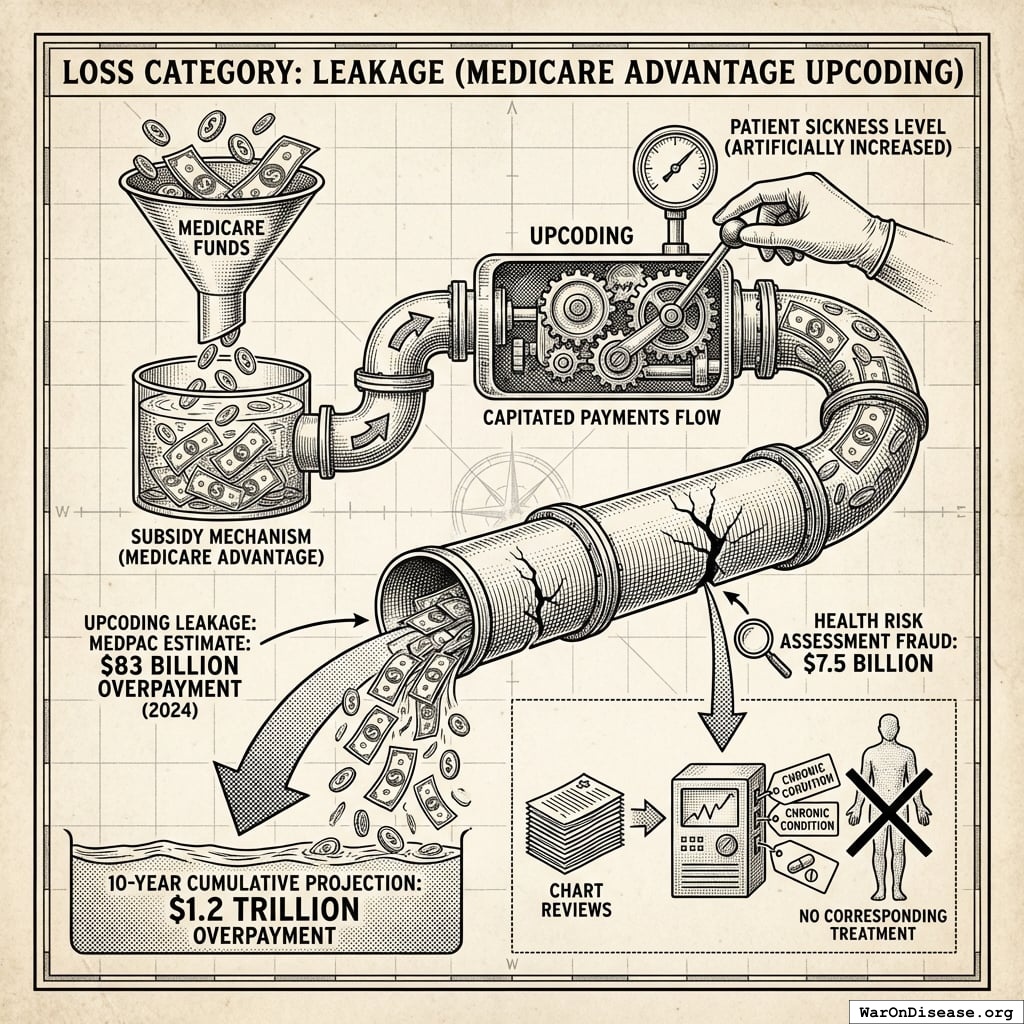

Loss Category: Leakage (Medicare Advantage Upcoding)

Medicare Advantage functions as a subsidy mechanism via “upcoding”: making patients appear sicker than they are to increase capitated payments.

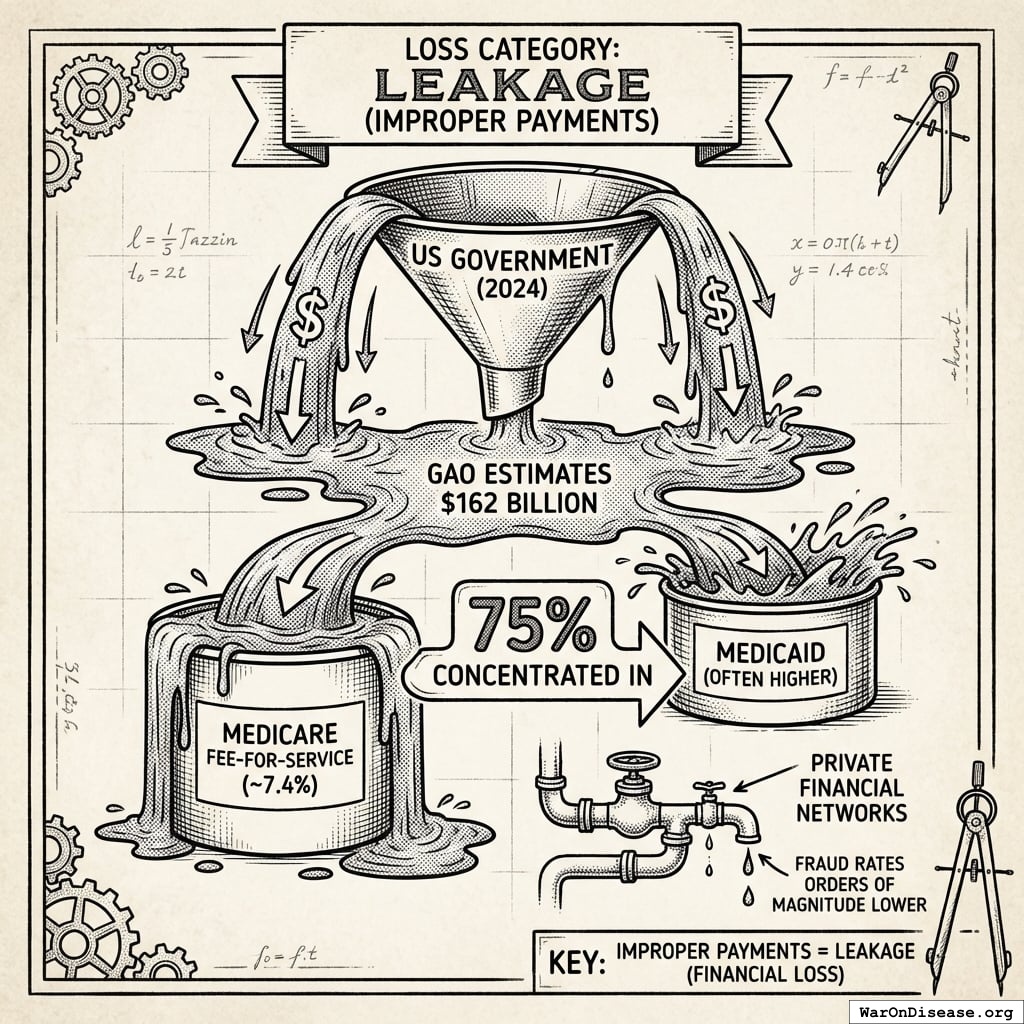

Loss Category: Leakage (Improper Payments)

GAO estimates $162 billion in improper payments government-wide in 2024, with 75% concentrated in Medicare and Medicaid165.

- Medicare Fee-for-Service: ~7.4% improper payment rate

- Medicaid: often higher

Private financial networks operate with fraud rates orders of magnitude lower.

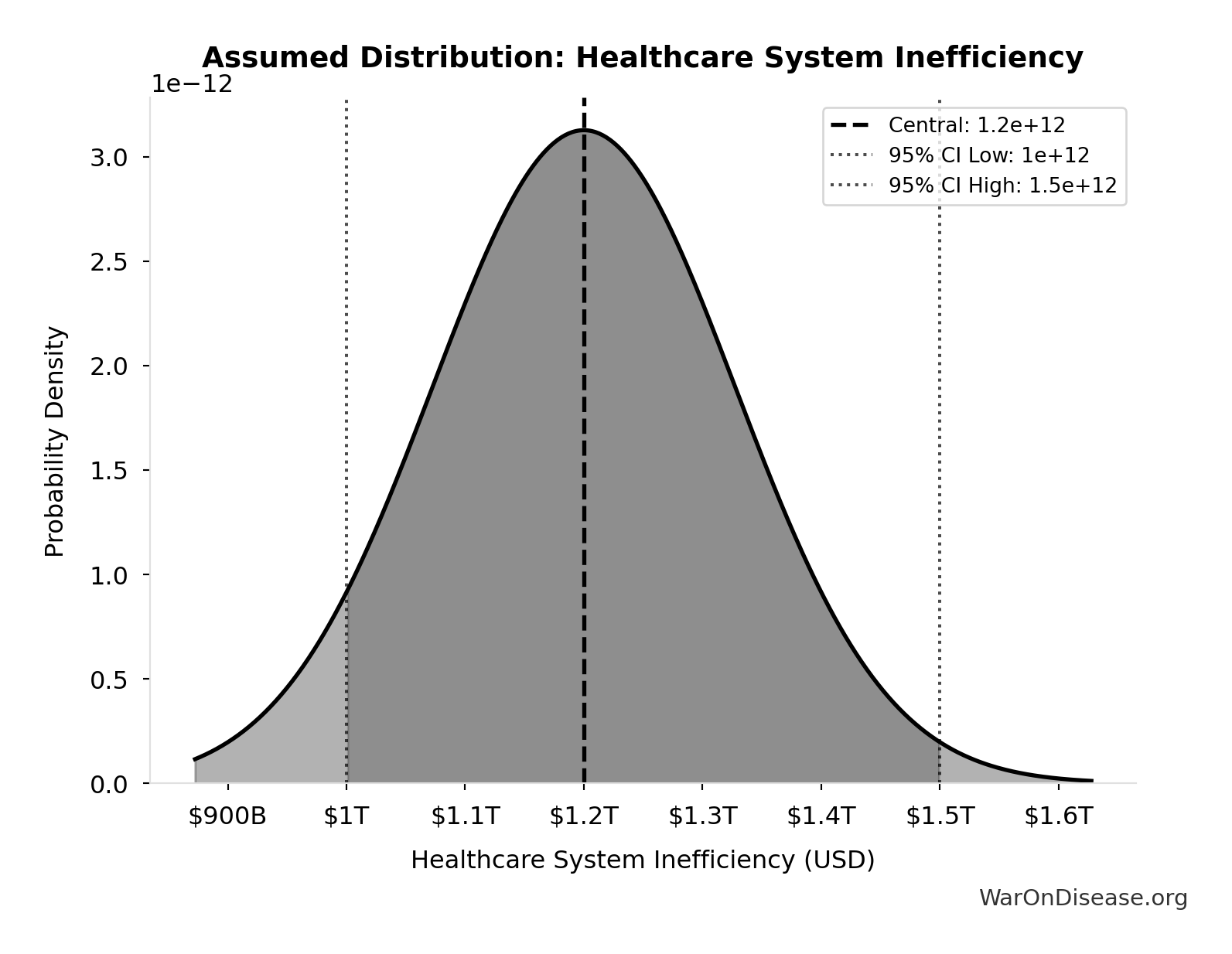

Healthcare Subsystem Summary

| Loss Category | Low Estimate | Mean | High Estimate |

|---|---|---|---|

| Friction (admin) | $250B | $335B | $400B |

| Leakage (MA upcoding) | $60B | $83B | $100B |

| Leakage (improper payments) | $80B | $120B | $150B |

| Total | $300B | $450B | $600B |

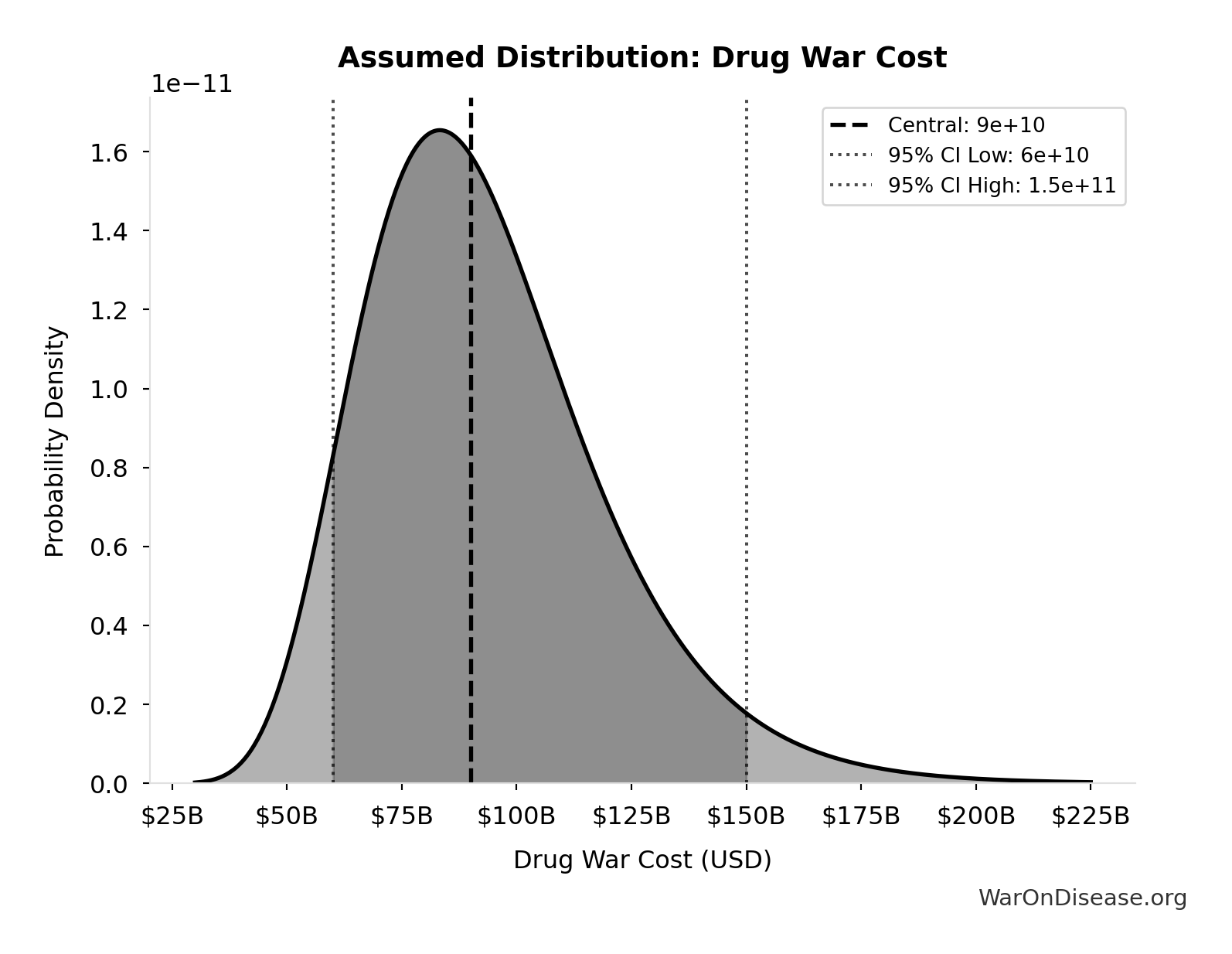

Subsystem Audit: Justice and Prohibition

The drug prohibition regime and resulting incarceration system represent sustained policy failure: intervention that fails to achieve stated objectives while generating substantial negative externalities.

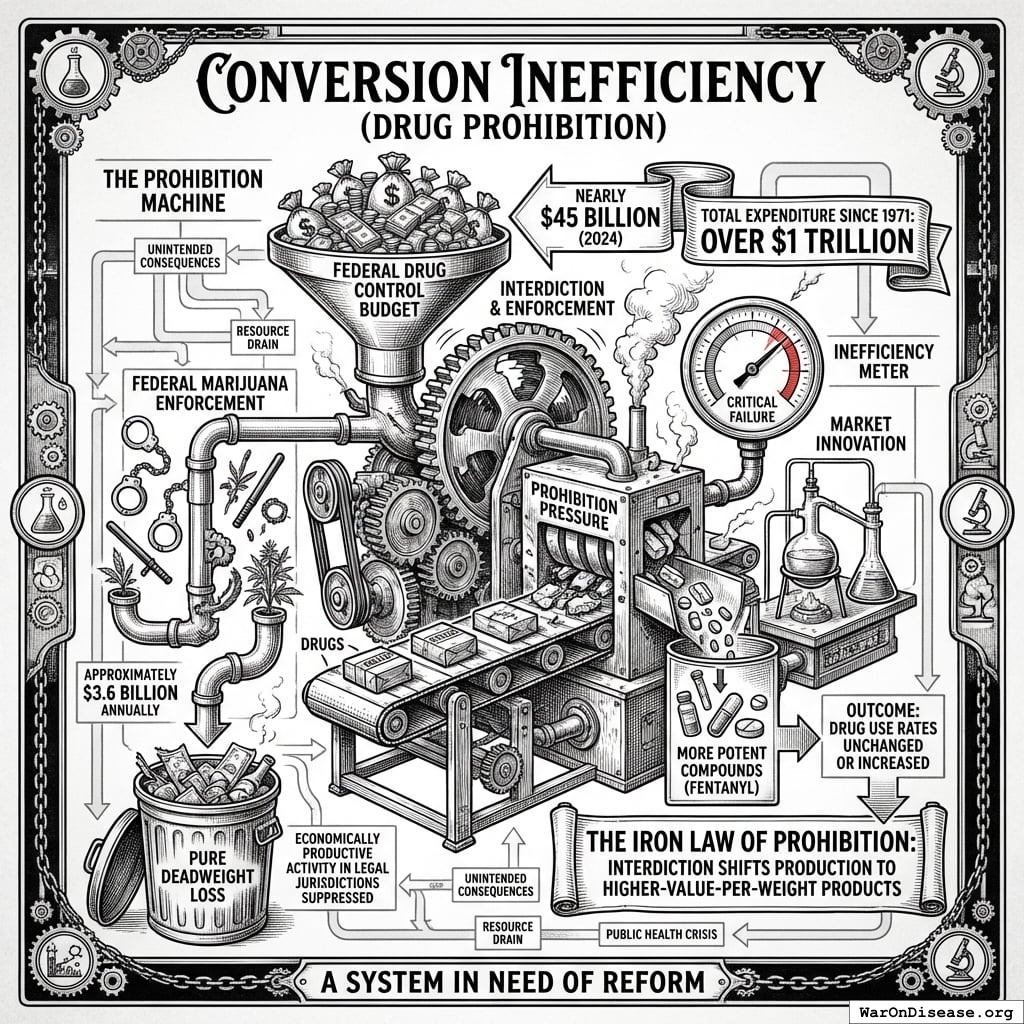

Loss Category: Conversion Inefficiency (Drug Prohibition)

The federal drug control budget for 2024: nearly $45 billion166. Total expenditure since 1971: over $1 trillion167.

Outcome: Drug use rates unchanged or increased168. The market has innovated toward more potent compounds (fentanyl). This is a direct consequence of the “Iron Law of Prohibition,” where interdiction shifts production to higher-value-per-weight products.

Despite state legalization, federal marijuana enforcement continues at approximately $3.6 billion annually169, pure deadweight loss on activity that is economically productive in legal jurisdictions.

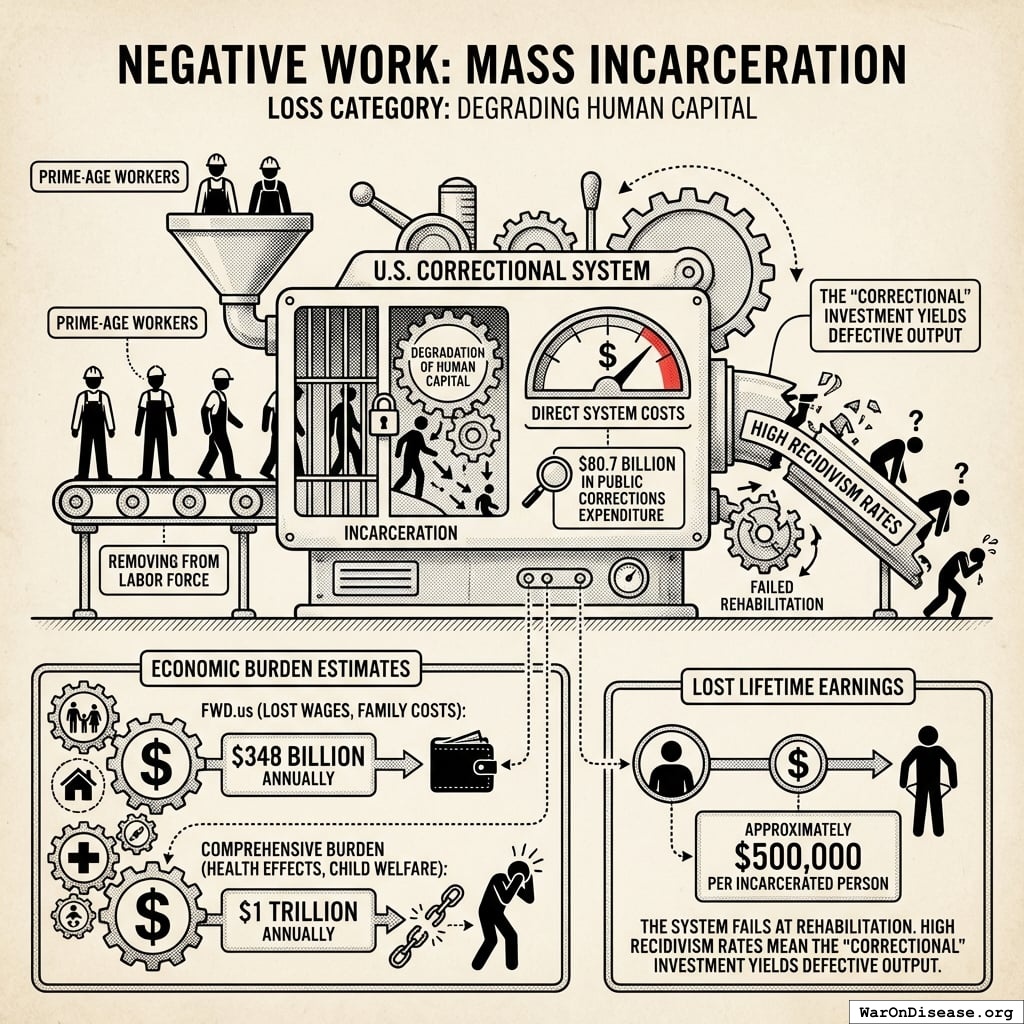

Loss Category: Negative Work (Mass Incarceration)

The U.S. incarcerates at rates unmatched in the developed world, removing prime-age workers from the labor force and degrading human capital.

Direct system costs: $80.7 billion in public corrections expenditure170

Economic burden estimates:

- FWD.us: $348 billion annually (lost wages, family costs)171

- Comprehensive burden (including health effects, child welfare): $1 trillion annually172

Lost lifetime earnings per incarcerated person: approximately $500,000170. The system fails at rehabilitation. High recidivism rates mean the “correctional” investment yields defective output.

Loss Category: Leakage (Civil Asset Forfeiture)

Civil asset forfeiture allows property seizure without criminal conviction. FY 2024 Treasury Forfeiture Fund: $2.26 billion processed173.

This mechanism incentivizes revenue-generating enforcement over public safety, introduces property rights uncertainty, and constitutes wealth transfer from productive activity to bureaucracy.

Justice Subsystem Summary

| Loss Category | Low Estimate | Mean | High Estimate |

|---|---|---|---|

| Conversion (drug enforcement) | $40B | $48B | $55B |

| Negative work (incarceration) | $80B | $280B | $500B |

| Leakage (forfeiture) | $2B | $2B | $3B |

| Total | $100B | $280B | $500B |

Note: The 6x range ($80B-$500B) for incarceration reflects genuine uncertainty. The low bound captures only direct corrections spending; the high bound includes comprehensive economic burden estimates (lost wages, family disruption, intergenerational effects). Different methodologies yield dramatically different figures.

Subsystem Audit: Regulatory and Tax Compliance

The compliance burden (time and resources consumed meeting federal requirements) represents a substantial unrecorded subtraction from national output.

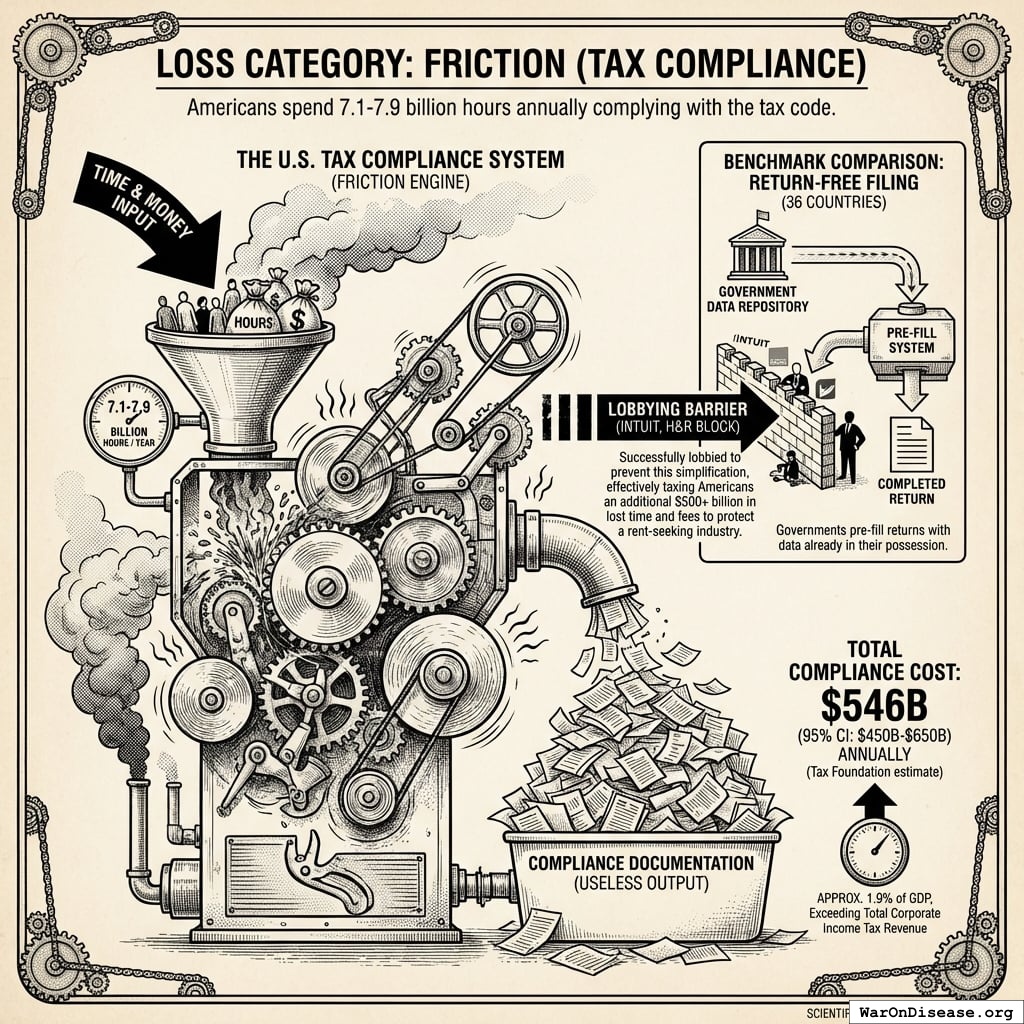

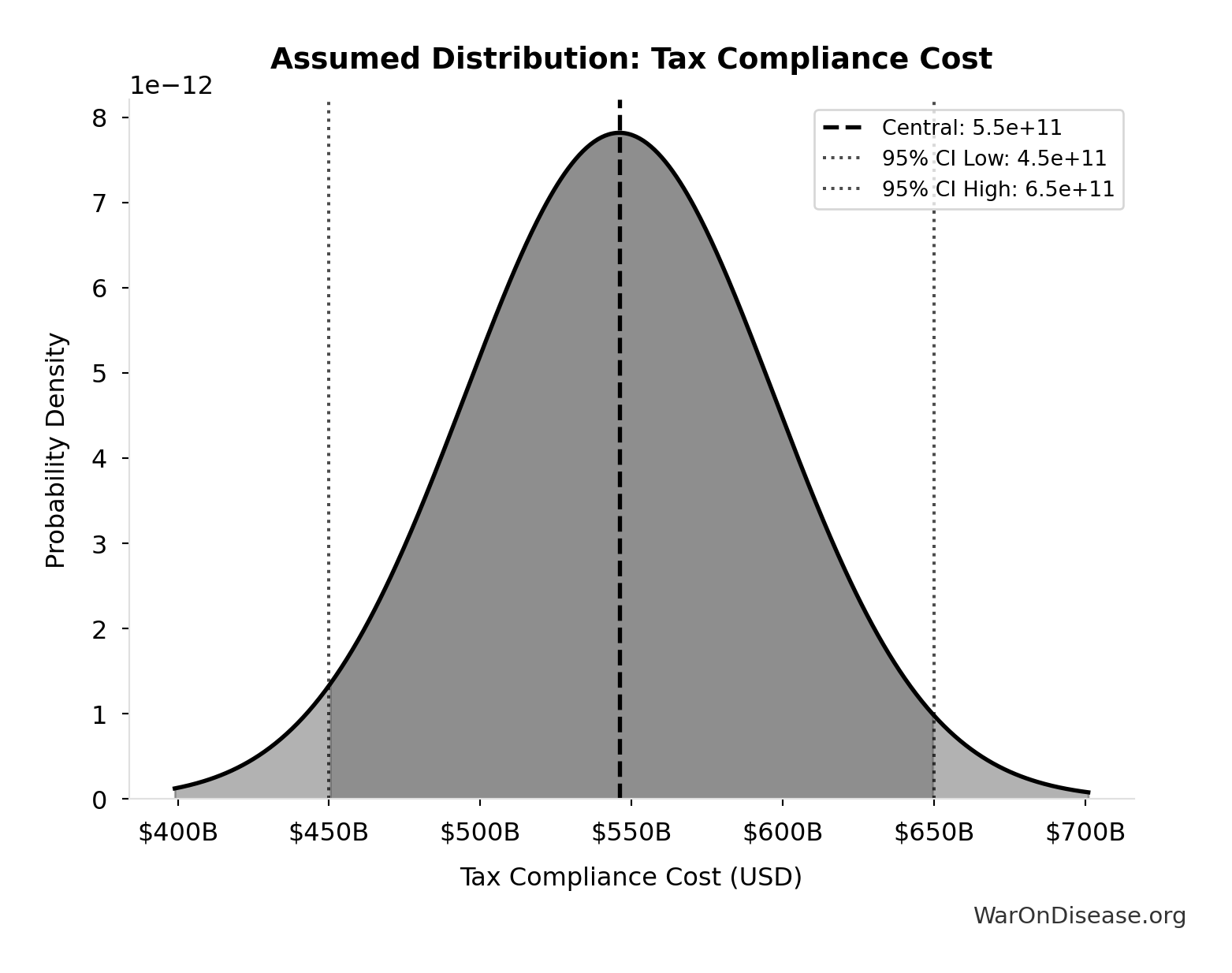

Loss Category: Friction (Tax Compliance)

Americans spend 7.1-7.9 billion hours annually complying with the tax code144.

Total compliance cost: $546B (95% CI: $450B-$650B) annually (Tax Foundation estimate)17,144

This is approximately 1.9% of GDP, exceeding total corporate income tax revenue. The labor produces nothing but compliance documentation.

Benchmark comparison: Thirty-six countries use “Return-Free Filing” where governments pre-fill returns with data already in their possession174. The U.S. tax preparation lobby (Intuit, H&R Block) has successfully lobbied to prevent this simplification175, effectively taxing Americans an additional $500+ billion in lost time and fees to protect a rent-seeking industry.

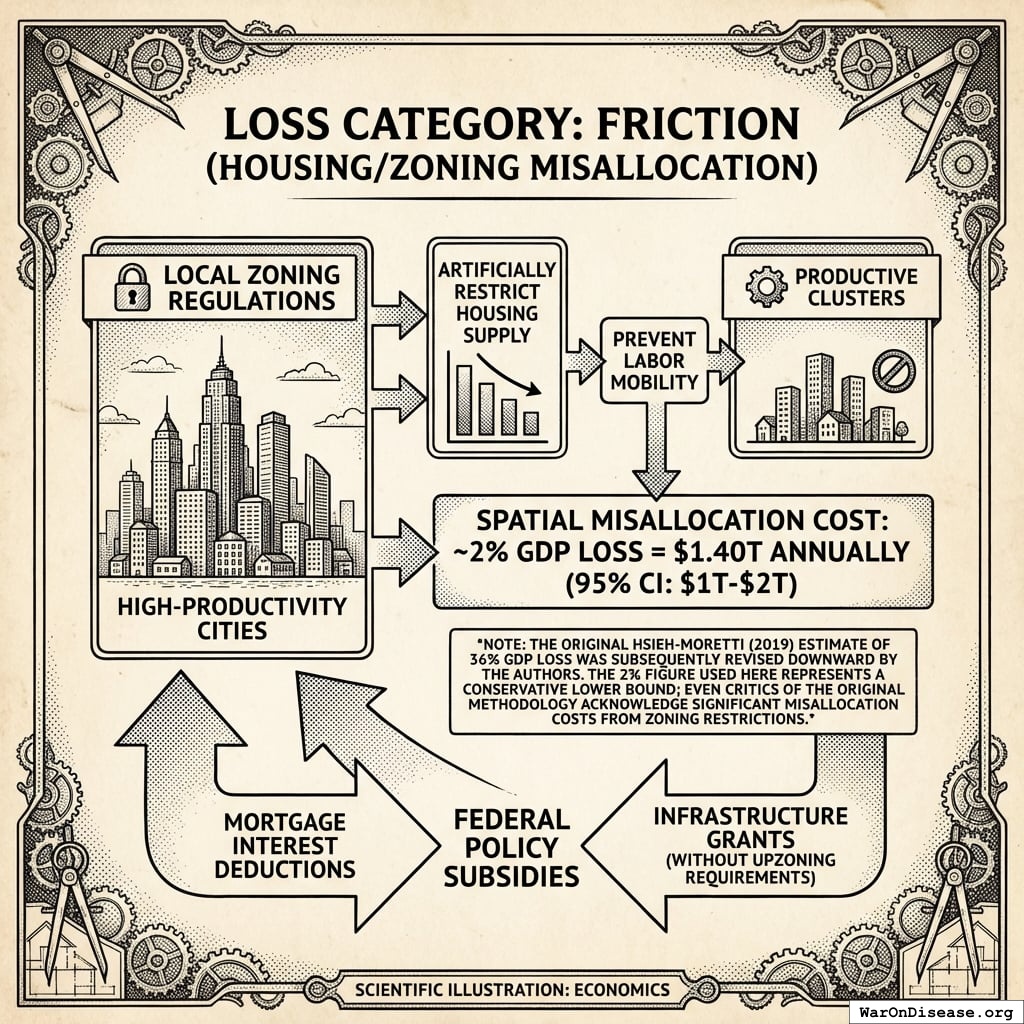

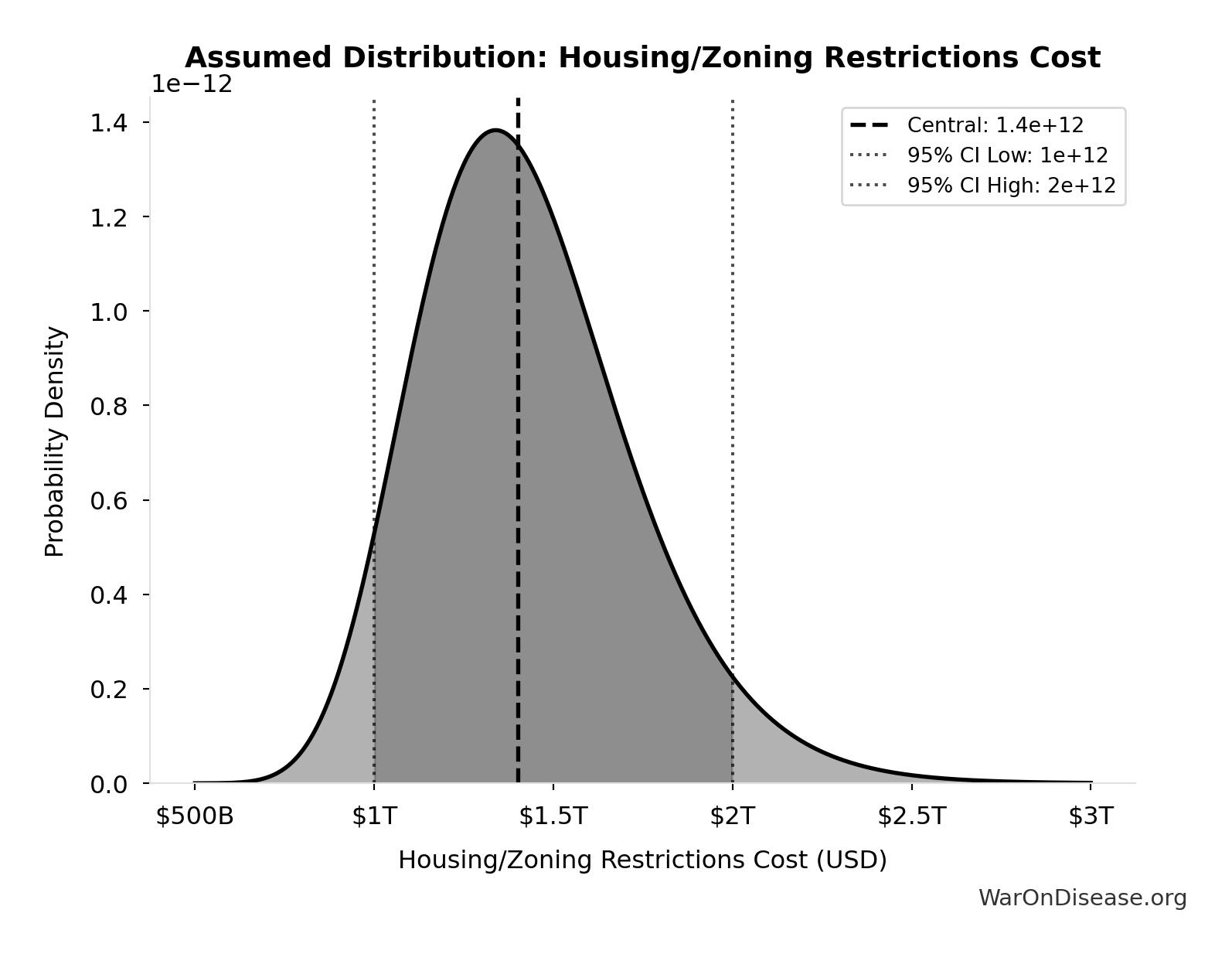

Loss Category: Friction (Housing/Zoning Misallocation)

Local zoning regulations artificially restrict housing supply in high-productivity cities, preventing labor mobility to productive clusters.

Spatial misallocation cost: Even conservative estimates point to 2% GDP loss = $1.40T (95% CI: $1T-$2T) annually176,177.

Note: The original Hsieh-Moretti (2019) estimate of 36% GDP loss was subsequently revised downward by the authors. The 2% figure used here represents a conservative lower bound; even critics of the original methodology acknowledge significant misallocation costs from zoning restrictions.

Federal policy subsidizes this dysfunction via mortgage interest deductions and infrastructure grants without upzoning requirements.

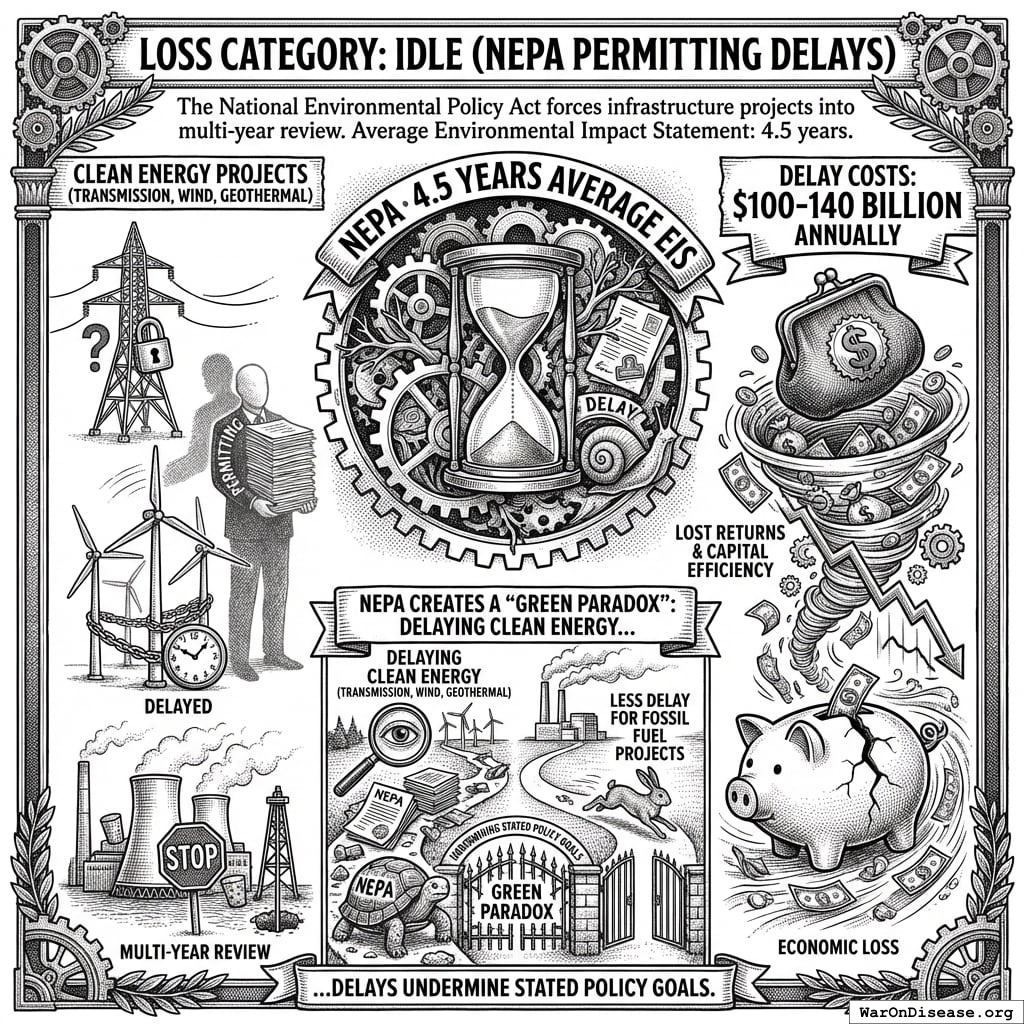

Loss Category: Idle (NEPA Permitting Delays)

The National Environmental Policy Act forces infrastructure projects into multi-year review. Average Environmental Impact Statement: 4.5 years.

Delay costs: $100-140 billion annually in lost returns and capital efficiency178.

NEPA creates a “Green Paradox”: delaying clean energy projects (transmission, wind, geothermal) more than fossil fuel projects, undermining stated policy goals.

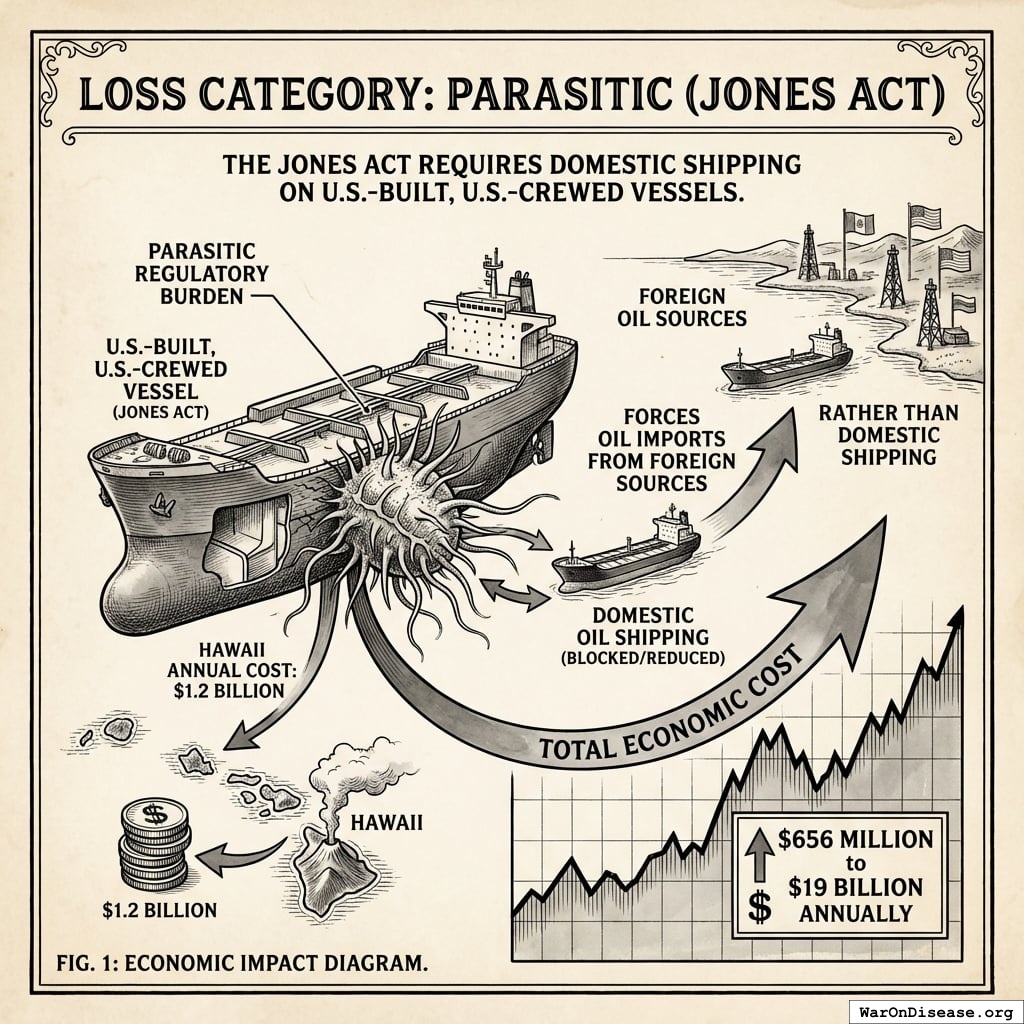

Loss Category: Parasitic (Jones Act)

The Jones Act requires domestic shipping on U.S.-built, U.S.-crewed vessels. Results:

Regulatory Subsystem Summary

| Loss Category | Low Estimate | Mean | High Estimate |

|---|---|---|---|

| Friction (tax compliance) | $464B | $505B | $546B |

| Friction (housing) | $300B | $560B | $700B |

| Idle (NEPA) | $100B | $120B | $140B |

| Parasitic (Jones Act) | $1B | $10B | $19B |

| Total | $600B | $900B | $1.2T |

Subsystem Audit: Subsidies and Transfers

Direct transfers to profitable industries distort market signals and insulate incumbents from innovation pressure.

Loss Category: Parasitic (Fossil Fuel Subsidies)

Direct annual subsidies to fossil fuel companies: $10-52 billion181.

This represents capital transfer to a mature, profitable industry, artificially lowering carbon-intensive energy costs relative to alternatives and slowing energy transition.

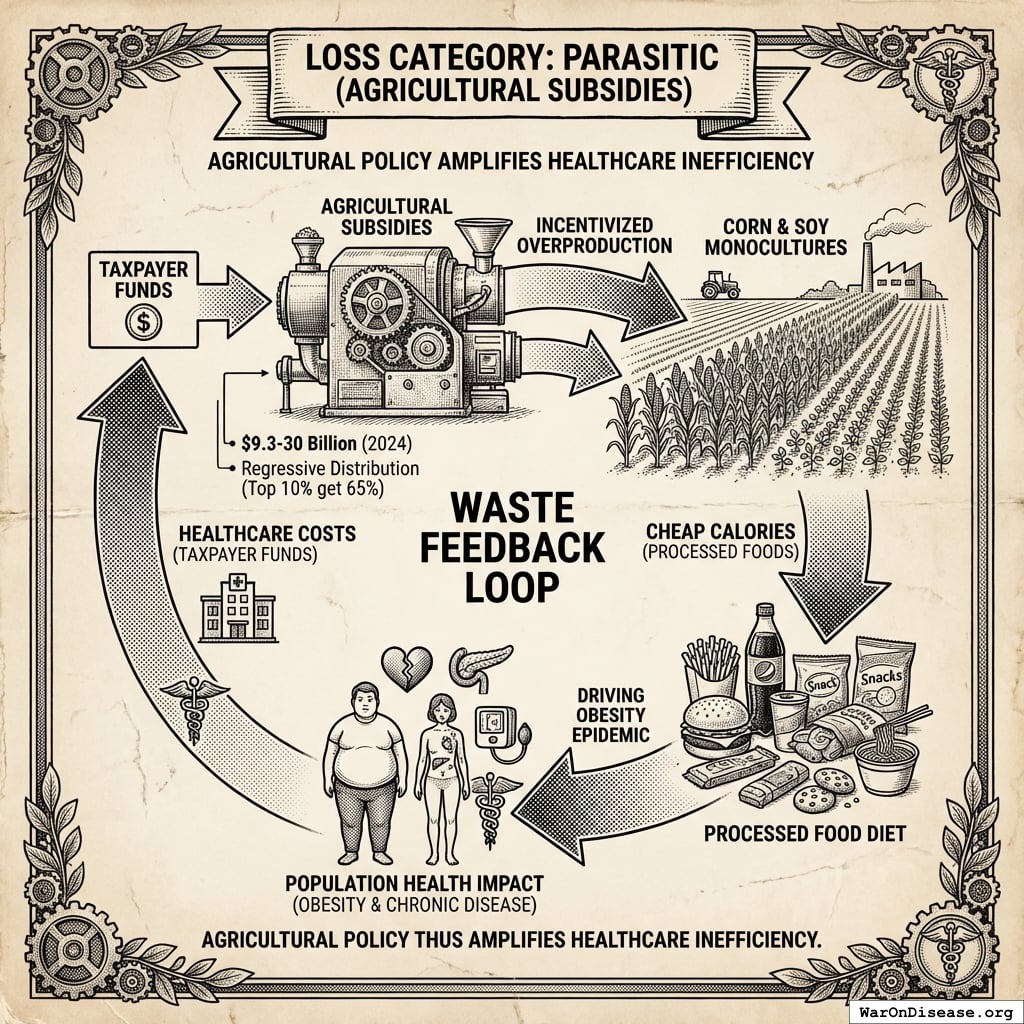

Loss Category: Parasitic (Agricultural Subsidies)

Agricultural subsidies in 2024: $9.3-30 billion182. Distribution is regressive. Top 10% of recipients received 65% of payments in 2024183.

The subsidy structure incentivizes overproduction of corn and soy, which form the backbone of the processed food diet driving the obesity epidemic. This creates a Waste Feedback Loop: taxpayer funds subsidize production of cheap calories that make the population sick, requiring additional taxpayer funds to treat the resulting chronic disease (see Healthcare subsystem). Agricultural policy thus amplifies healthcare inefficiency.

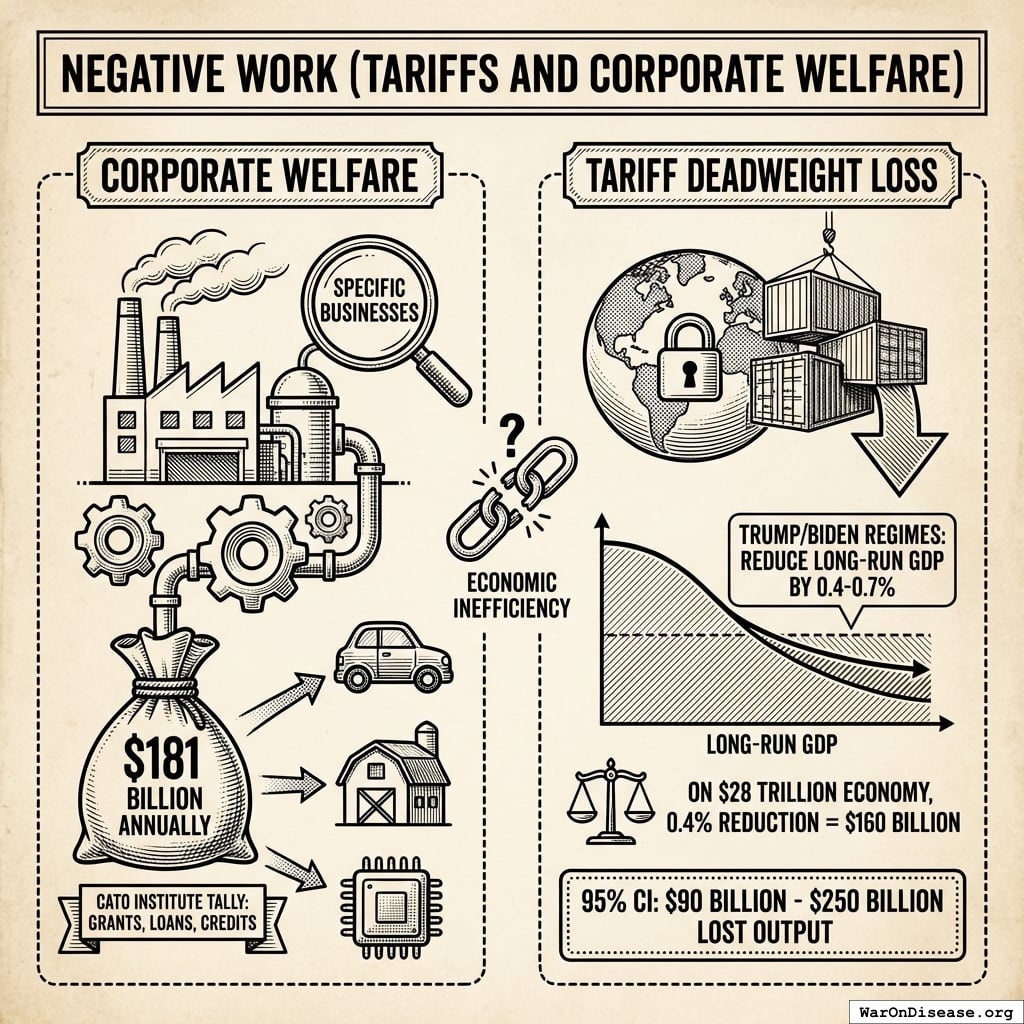

Loss Category: Negative Work (Tariffs and Corporate Welfare)

Corporate welfare: Cato Institute tallies $181 billion annually in grants, loans, and credits to specific businesses184.

Tariff deadweight loss: Trump/Biden tariff regimes estimated to reduce long-run GDP by 0.4-0.7%185. On a $28 trillion economy, 0.4% reduction = $160B (95% CI: $90B-$250B) in lost output.

Subsidies Subsystem Summary

| Loss Category | Low Estimate | Mean | High Estimate |

|---|---|---|---|

| Parasitic (fossil fuel) | $10B | $30B | $52B |

| Parasitic (agriculture) | $9B | $20B | $30B |

| Parasitic (corporate) | $150B | $181B | $200B |

| Negative work (tariffs) | $80B | $112B | $150B |

| Total | $200B | $280B | $350B |

Aggregate Efficiency Calculation

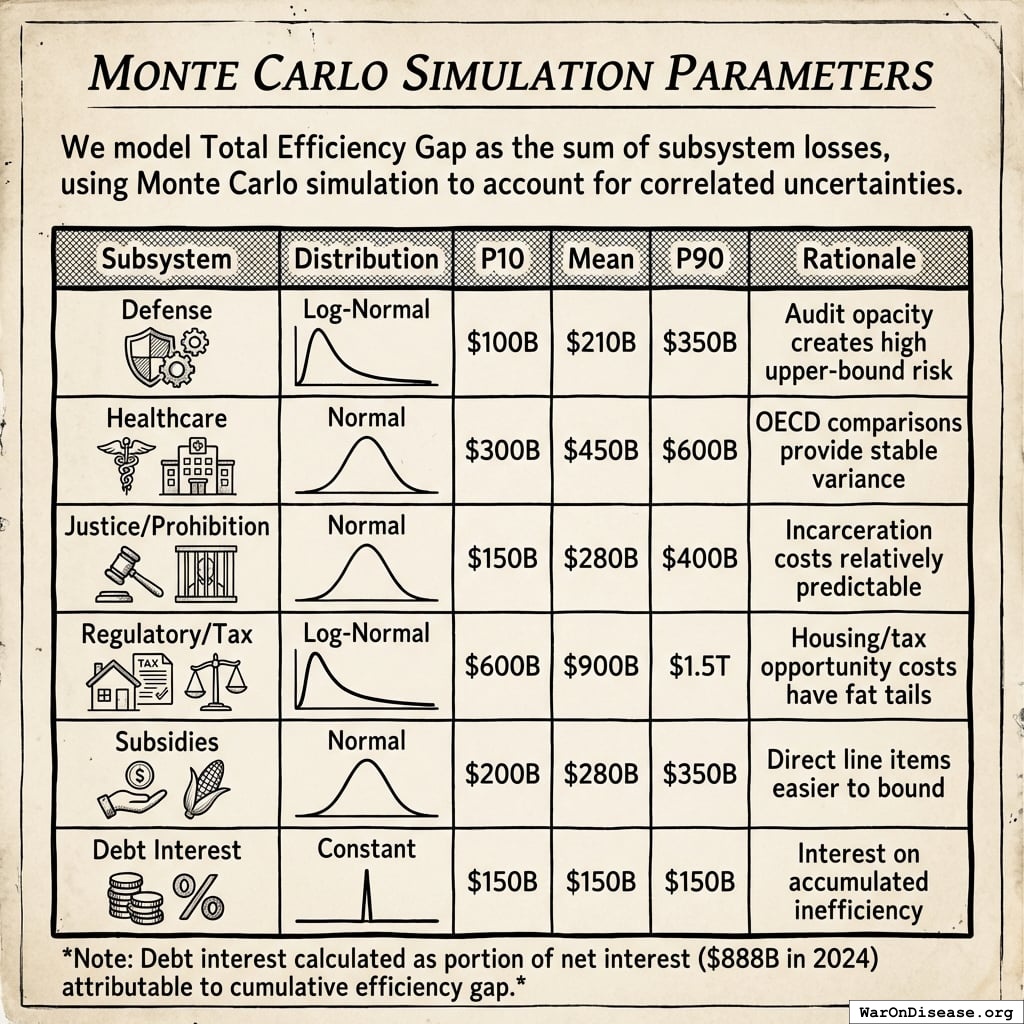

Monte Carlo Simulation Parameters

We model Total Efficiency Gap as the sum of subsystem losses, using Monte Carlo simulation to account for correlated uncertainties.

| Subsystem | Distribution | P10 | Mean | P90 | Rationale |

|---|---|---|---|---|---|

| Defense | Log-Normal | $100B | $210B | $350B | Audit opacity creates high upper-bound risk |

| Healthcare | Normal | $300B | $450B | $600B | OECD comparisons provide stable variance |

| Justice/Prohibition | Normal | $150B | $280B | $400B | Incarceration costs relatively predictable |

| Regulatory/Tax | Log-Normal | $600B | $900B | $1.5T | Housing/tax opportunity costs have fat tails |

| Subsidies | Normal | $200B | $280B | $350B | Direct line items easier to bound |

| Debt Interest | Constant | $150B | $150B | $150B | Interest on accumulated inefficiency |

Note: Debt interest calculated as portion of net interest ($888B in 2024)186 attributable to cumulative efficiency gap.

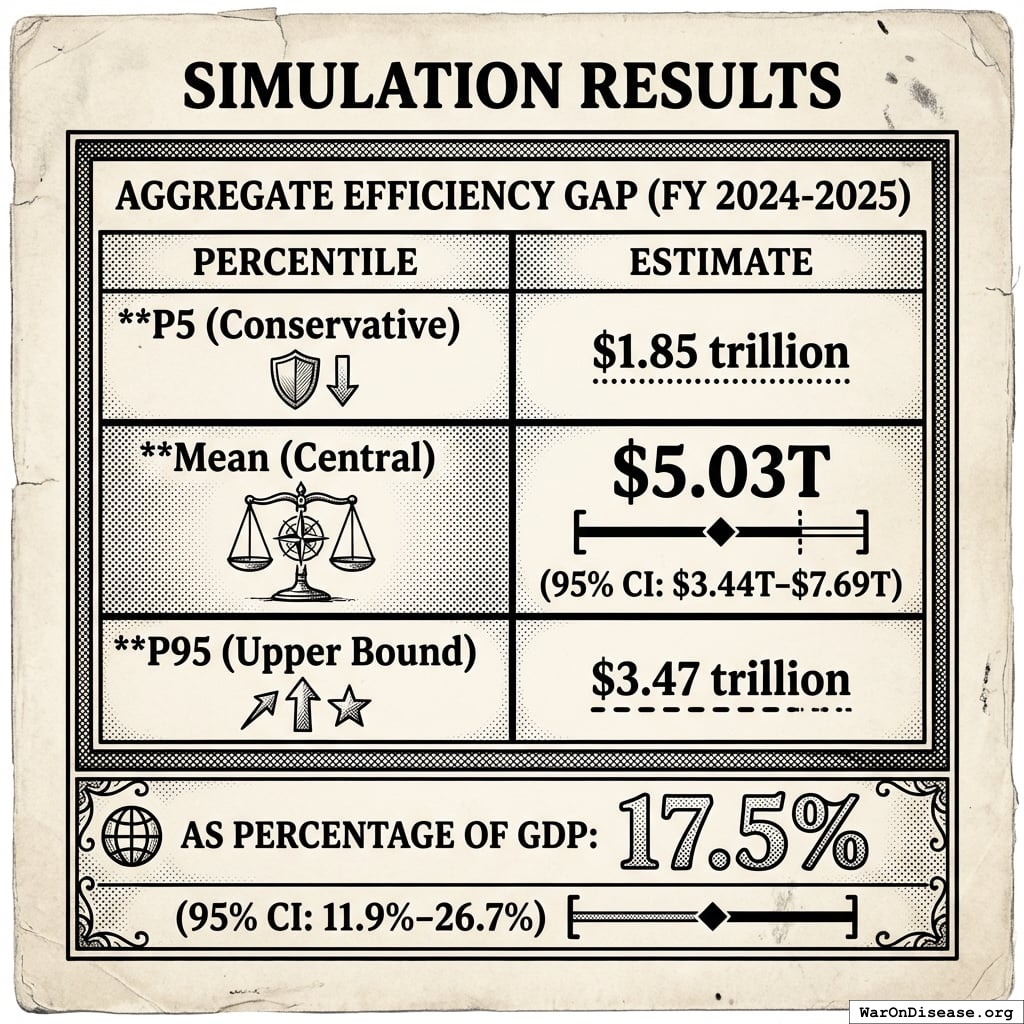

Simulation Results

Aggregate Efficiency Gap (FY 2024-2025):

| Percentile | Estimate |

|---|---|

| P5 (Conservative) | $1.85 trillion |

| Mean (Central) | |

| P95 (Upper Bound) | $3.47 trillion |

As percentage of GDP: 17.5% (95% CI: 11.9%-26.7%)

Subsystem Uncertainty Distributions

The following figures show Monte Carlo distributions for key subsystem loss estimates:

This chart shows the assumed probability distribution for this parameter. The shaded region represents the 95% confidence interval where we expect the true value to fall.

This chart shows the assumed probability distribution for this parameter. The shaded region represents the 95% confidence interval where we expect the true value to fall.

This chart shows the assumed probability distribution for this parameter. The shaded region represents the 95% confidence interval where we expect the true value to fall.

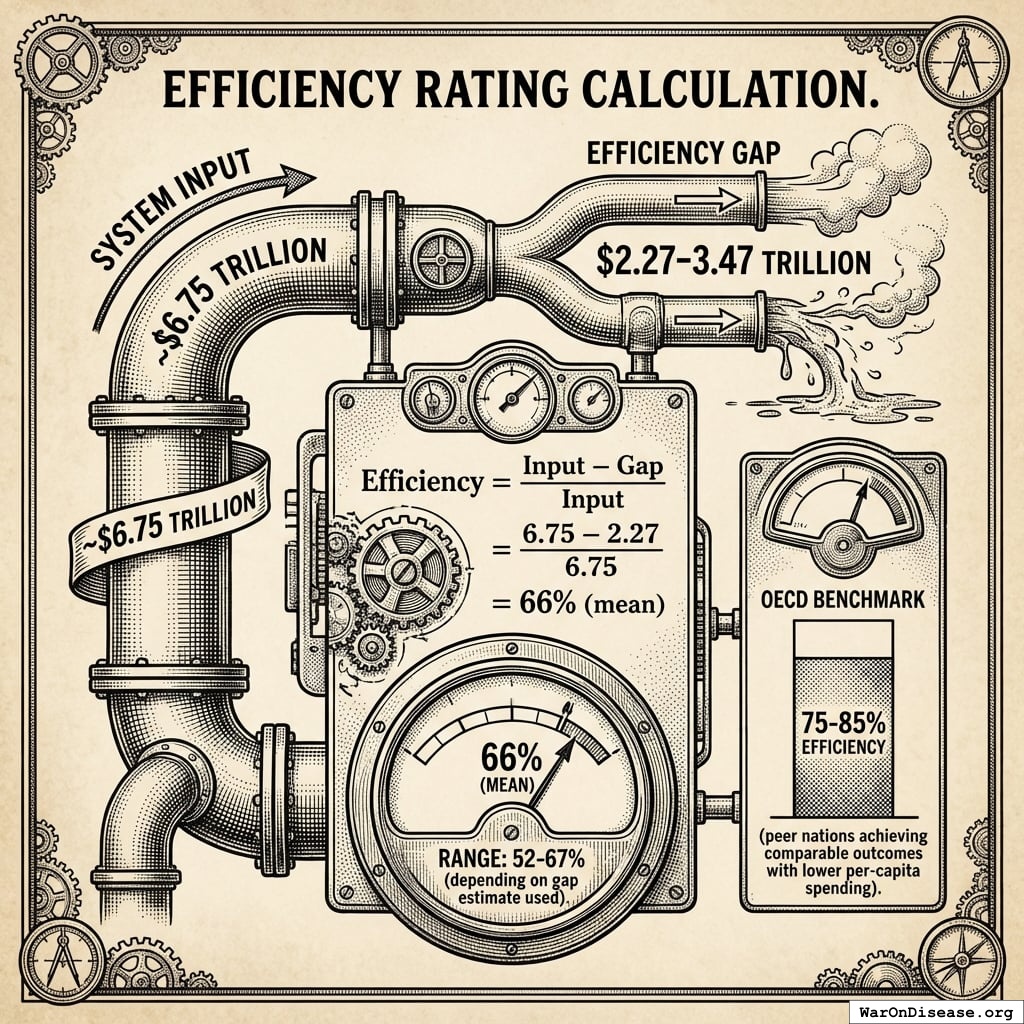

Efficiency Rating Calculation

With system input of ~$6.75 trillion and efficiency gap of $2.27-3.47 trillion:

\[\text{Efficiency} = \frac{\text{Input} - \text{Gap}}{\text{Input}} = \frac{6.75 - 2.27}{6.75} = 66\% \text{ (mean)}\]

Range: 52-67% depending on gap estimate used.

OECD benchmark: 75-85% efficiency (peer nations achieving comparable outcomes with lower per-capita spending).

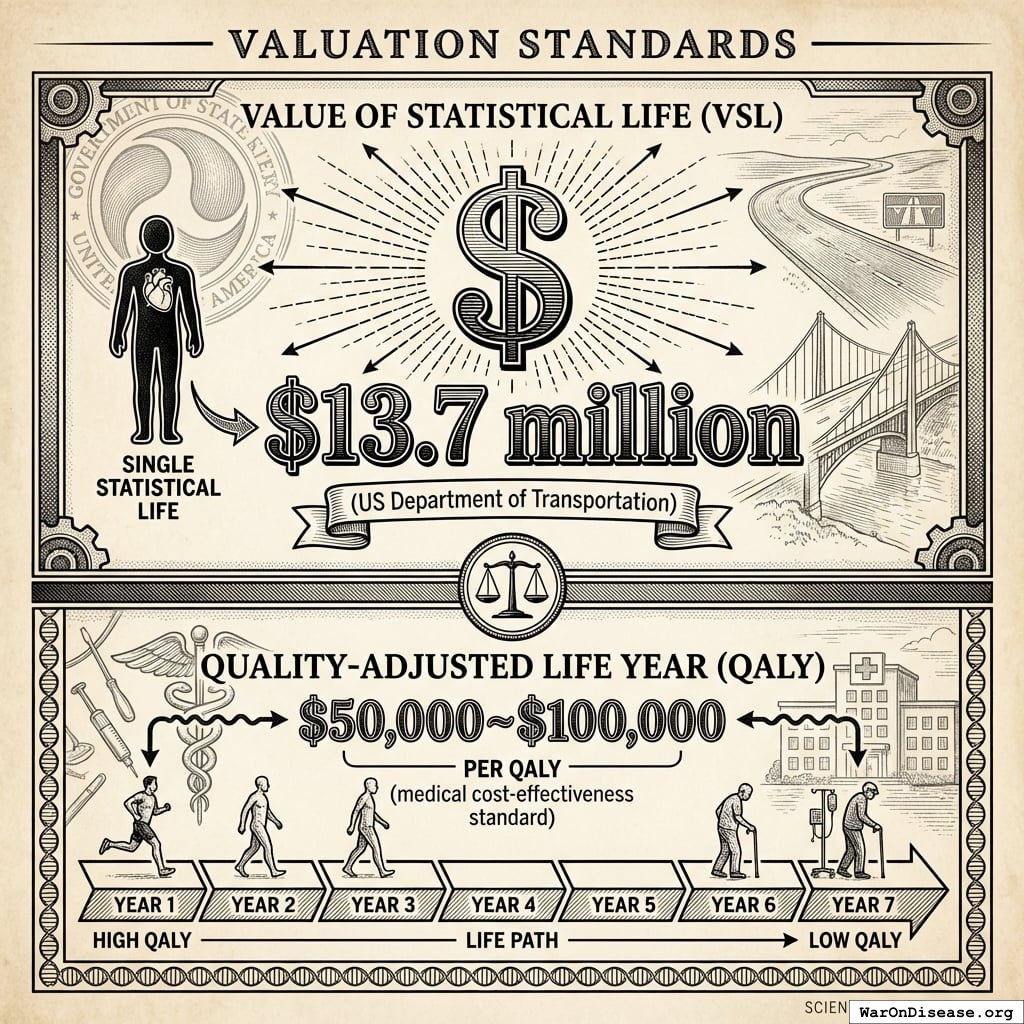

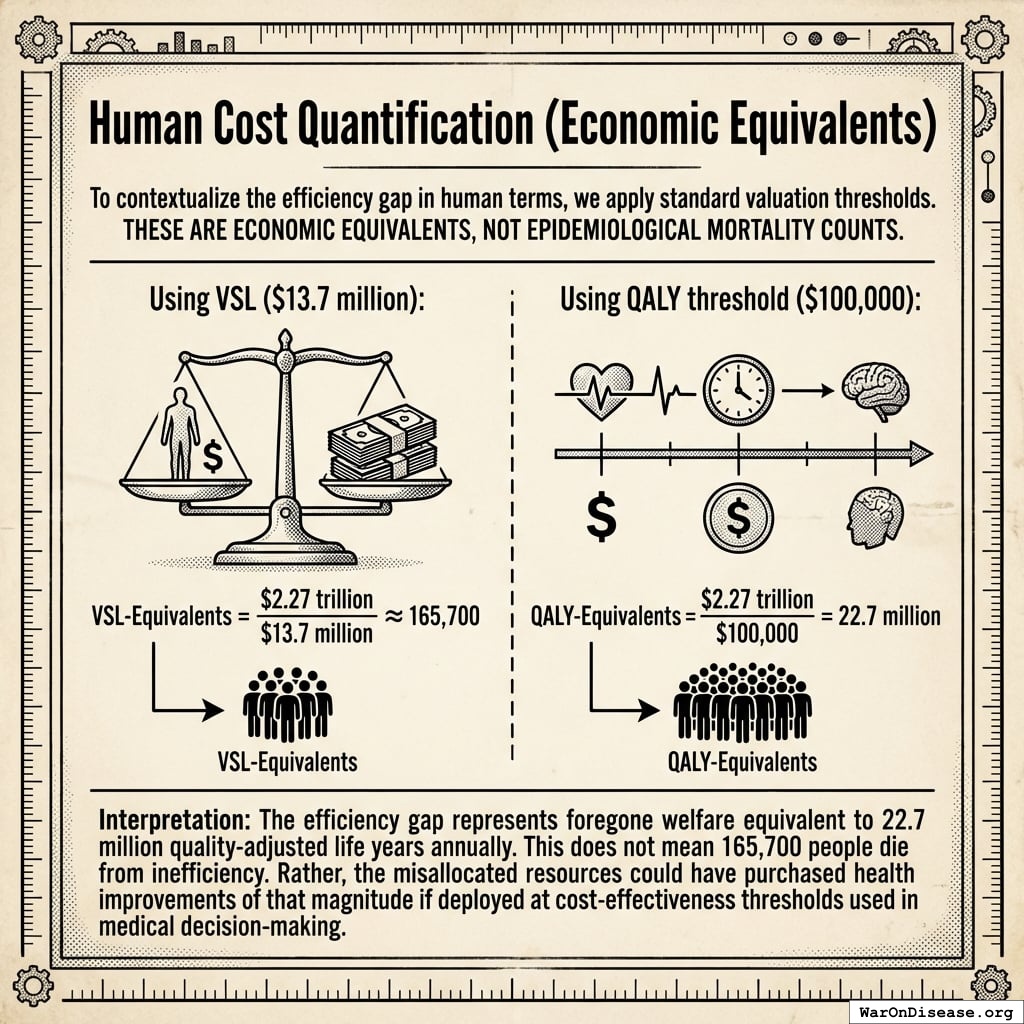

Human Cost Quantification (Economic Equivalents)

To contextualize the efficiency gap in human terms, we apply standard valuation thresholds. These are economic equivalents, not epidemiological mortality counts.

**Using VSL (\(13.7 million):**\)\(\text{VSL-Equivalents} = \frac{\$2.27 \text{ trillion}}{\$13.7 \text{ million}} \approx 165,700\)$

**Using QALY threshold (\(100,000):**\)\(\text{QALY-Equivalents} = \frac{\$2.27 \text{ trillion}}{\$100,000} = 22.7 \text{ million}\)$

Interpretation: The efficiency gap represents foregone welfare equivalent to 22.7 million quality-adjusted life years annually. This does not mean 165,700 people die from inefficiency. Rather, the misallocated resources could have purchased health improvements of that magnitude if deployed at cost-effectiveness thresholds used in medical decision-making.

Reallocation Potential

If U.S. efficiency improved to OECD median (80%), approximately $1.5 trillion annually becomes available for reallocation.

Context Comparisons

| Initiative | Annual Cost | Efficiency Gap Coverage |

|---|---|---|

| 1% Treaty funding | 55x covered | |

| Global disease R&D (current) | $150B187 | Would 10x |

| U.S. infrastructure backlog | $2.6T total188 | Covered in <2 years |

| Global poverty elimination | ~$175B189 | 8x covered |

| Complete grid decarbonization | $100B/year190 | 15x covered |

The efficiency gap is not abstract accounting. It represents real capacity currently unavailable for health, infrastructure, and security improvements.

Structural Factors

Why do these losses persist despite apparent obviousness? Several structural factors explain system inertia:

Severed Feedback Loops

Government programs lack market feedback mechanisms. A private firm losing $210 billion annually on inefficient logistics would face bankruptcy. Federal agencies face no equivalent selection pressure.

Principal-Agent Misalignment

Those administering programs (bureaucrats, contractors) have incentives misaligned with program objectives. Contractors profit from complexity; administrators expand headcount regardless of output.

Measurement Failure

Current accounting measures expenditure, not utility. A dollar spent equals a dollar of “activity” regardless of outcome. Without output measurement, optimization is impossible.

Monopoly Dynamics

Government services typically face no competition. Without competitive pressure, innovation lags and costs inflate. This is the standard monopoly outcome.

Time Horizon Mismatch

Political cycles (2-4 years) misalign with infrastructure and policy cycles (10-30 years). Long-term efficiency investments lose to short-term visible spending.

Confidence Intervals and Limitations

Estimate Confidence by Subsystem

| Subsystem | Data Quality | Confidence |

|---|---|---|

| Healthcare Admin | High (OECD comparisons) | High |

| Tax Compliance | High (IRS data) | High |

| Defense Audit | Low (61% unaccounted) | Medium |

| Incarceration | Medium (direct costs clear, indirect estimated) | Medium |

| Housing Misallocation | Medium (model-dependent) | Medium |

| Drug War Opportunity Cost | Low (counterfactual) | Low |

What This Analysis Excludes

- State/local inefficiency beyond federal mandates

- Implicit subsidies (unpriced externalities)

- Intergenerational costs (debt burden on future)

- Second-order behavioral effects

- International competitiveness losses

Including these factors would increase the efficiency gap estimate substantially.

Methodological Limitations

- Counterfactual uncertainty: Some estimates require modeling what “would have happened” under alternative policies

- Attribution challenges: Separating federal from state/local effects

- Valuation debates: VSL and QALY thresholds vary by methodology

- Data opacity: DoD audit failures mean some estimates are necessarily imprecise

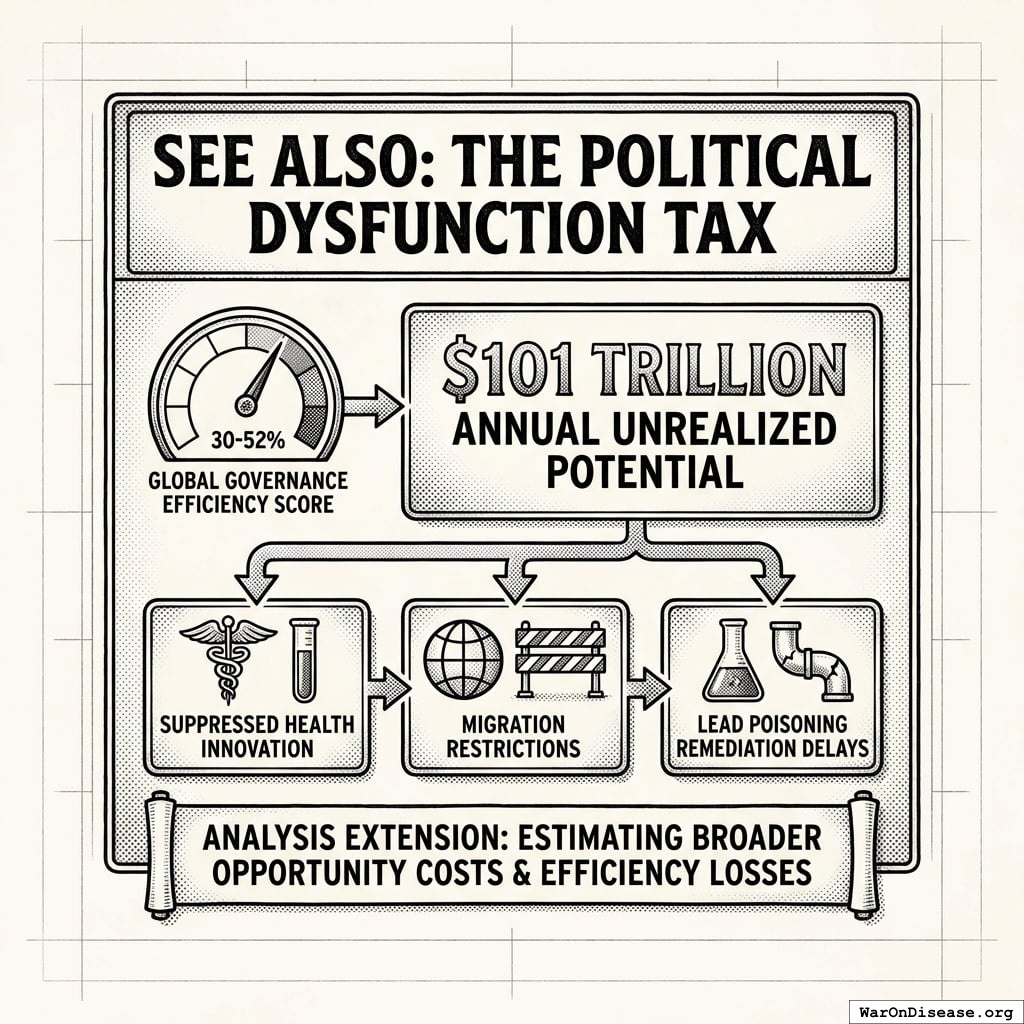

For global perspective on governance efficiency and broader opportunity costs of political dysfunction, see The Political Dysfunction Tax, which extends this analysis to estimate a Global Governance Efficiency Score of 30-52% and identifies $101 trillion in annual unrealized potential from suppressed health innovation, migration restrictions, and lead poisoning remediation delays.